Published on 04 May 2022

Overview

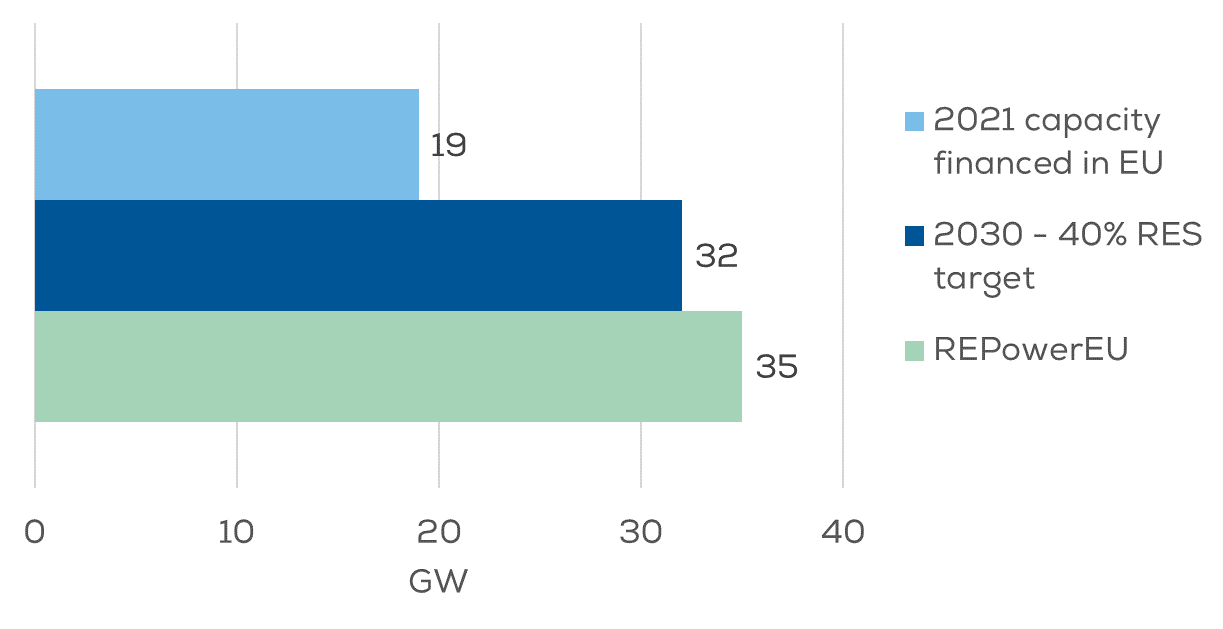

In the EU, 19 GW of new projects were financed, well below the required rate of 32 GW per year to meet the current 40% renewable energy targets. Wind energy projects make an attractive investment and in the long-term there should be plenty of capital available to finance them but issues with permitting must be resolved to prevent delays.

Findings

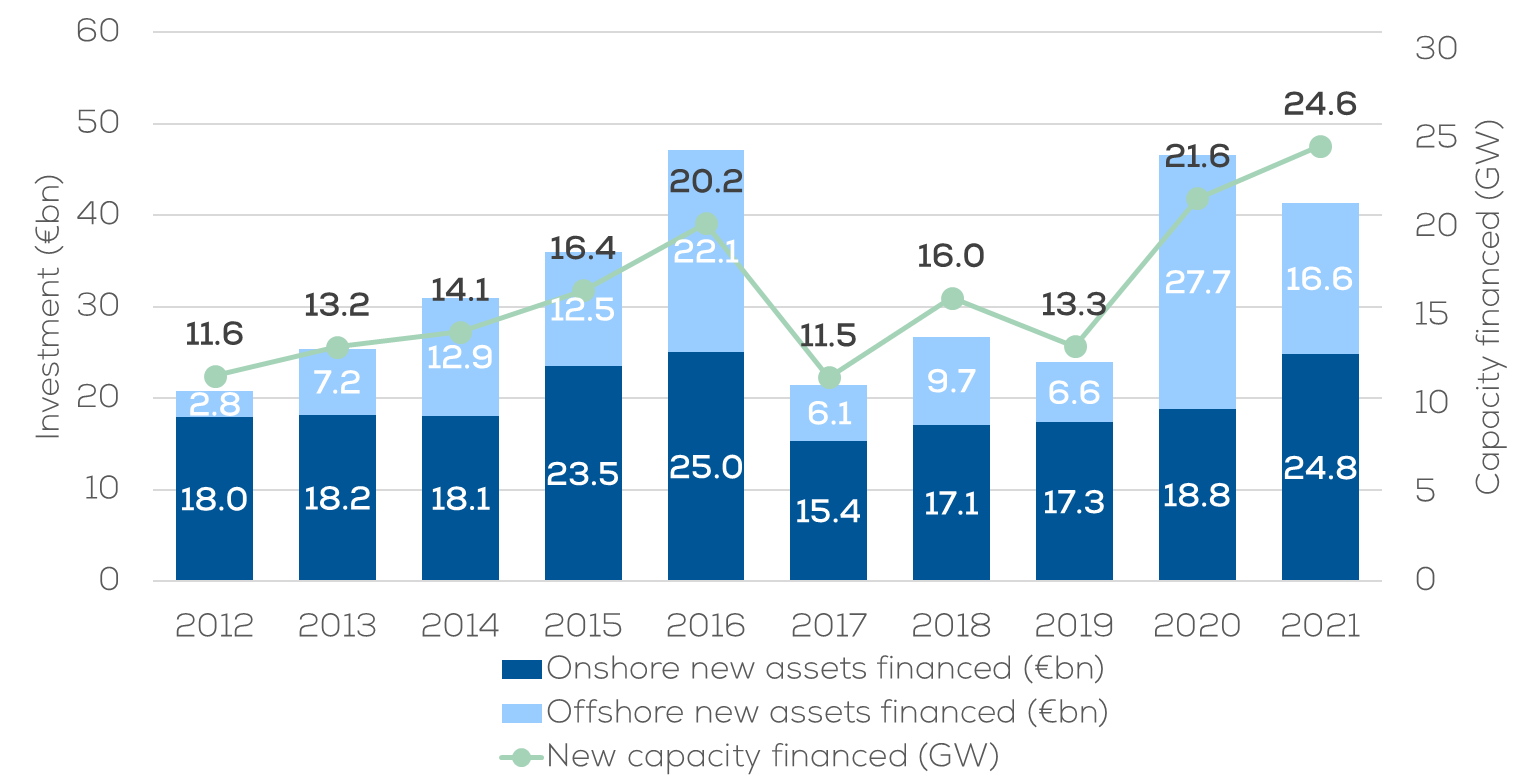

€41.4bn was invested for the construction of new wind farms. Over the next few years, these investments will result in 24.6 GW of new wind farm capacity being connected to the grid.

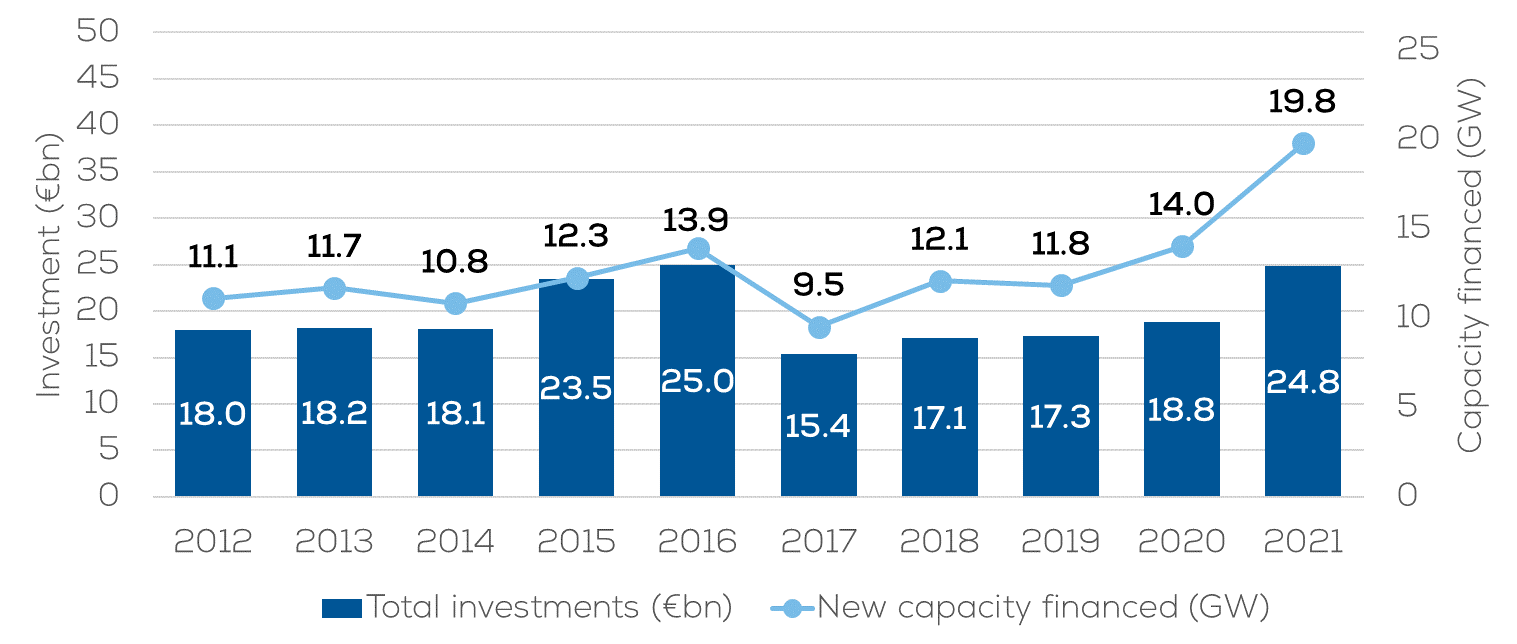

Onshore wind investment was similar in monetary terms to the record €25bn seen in 2016. But in 2021, the investments financed a record amount of capacity (19.8 GW) as a result of lower capital expenditures per MW.

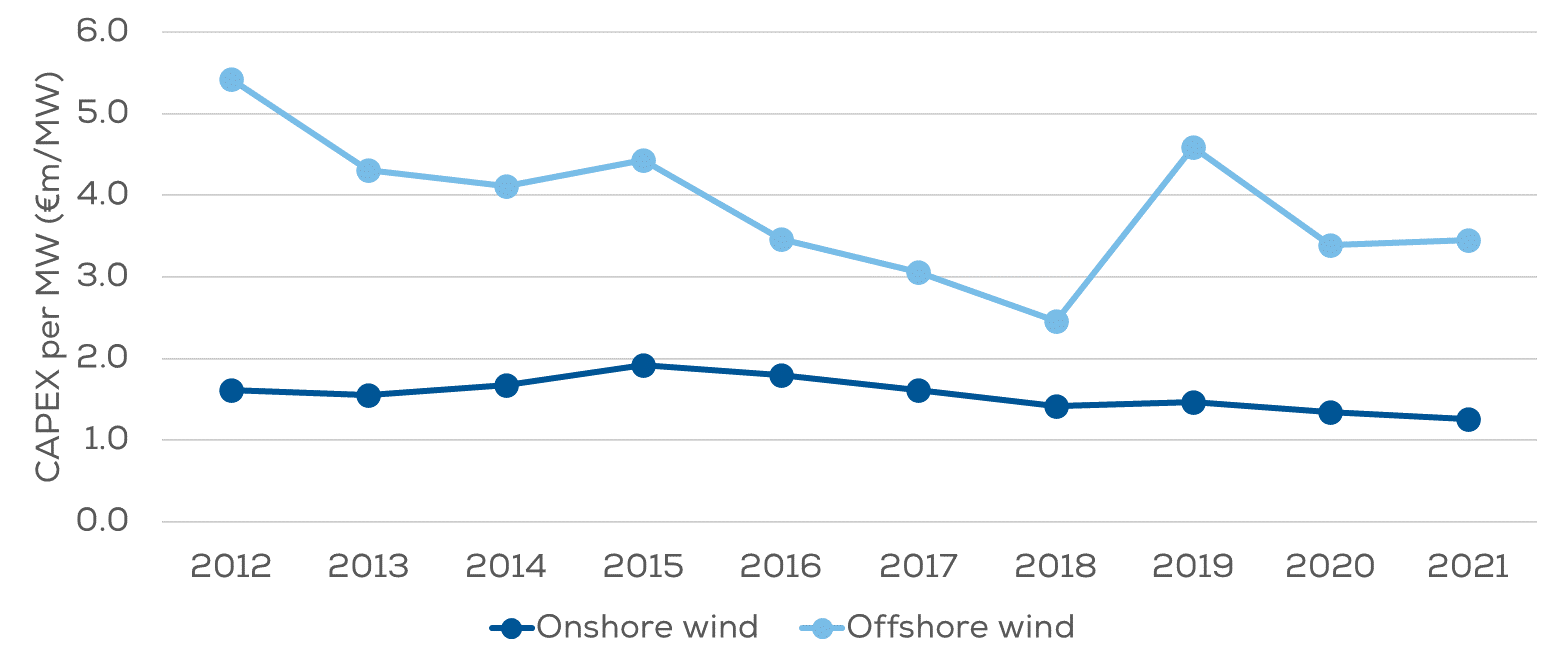

Capital expenditure (CAPEX) per MW has been decreasing over the years for onshore and offshore wind. However, inflationary pressures resulting from high energy prices and disruption to global supply chains will likely mean there will be no further cost reductions.

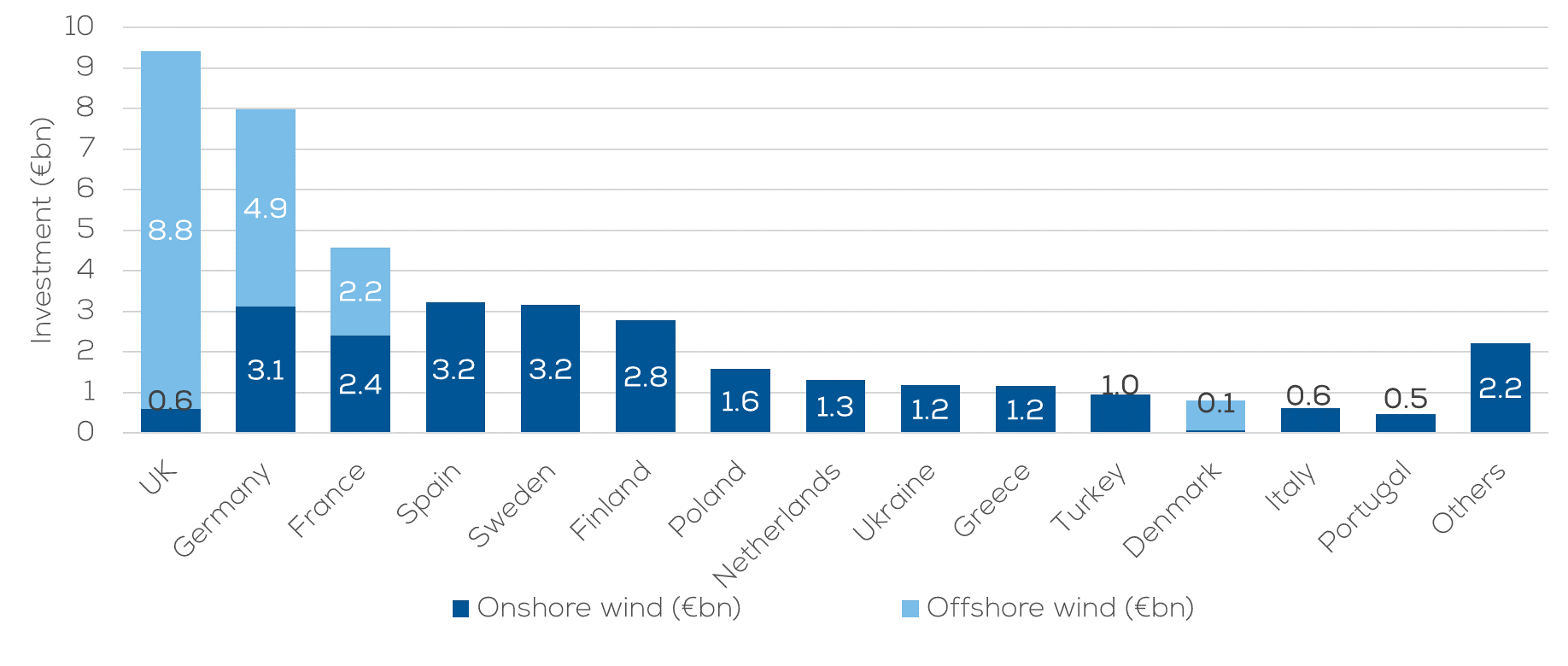

The UK invested the most in new wind farms in 2021, with the final investment decisions taken on Sofia (1.4 GW) and Dogger Bank C (1.2 GW) offshore wind farms raising €8.8bn of capital. Germany and France also saw significant investments in both onshore and offshore wind farms.

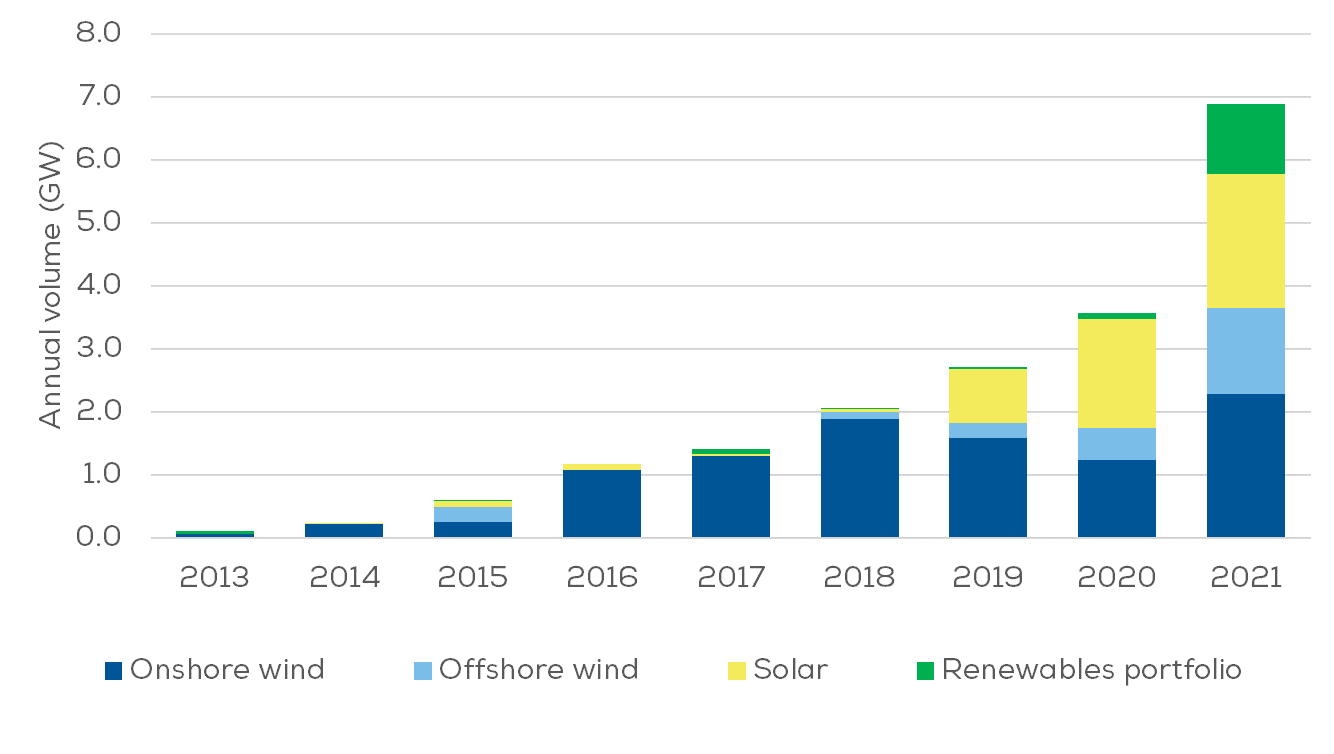

It was another record year for corporate renewable PPAs in Europe with almost 7 GW of capacity contracted in 97 deals. Wind energy represents 2/3rds of the total 18.8 GW of contracted capacity.

The European Commission’s REPowerEU communication has proposed a new target of 480 GW of installed wind energy capacity in the EU by 2030 to combat high energy prices and increase energy security. This would require annual installations of 35 GW per year in the EU between 2022 and 2030 – in 2021 just 19 GW of new wind capacity was financed in the EU.

Please log in to see this section.

Please log in to see this section.

Please log in to see this section.