Published on 29 March 2023

Overview

In the EU, 10 GW of new projects were financed, well below the required rate of 31 GW per year to meet energy and climate targets. Financing conditions have become more difficult but wind energy projects should find plenty of capital available but National Governments must restore investor confidence. The electricity market design reform should help here.

Findings

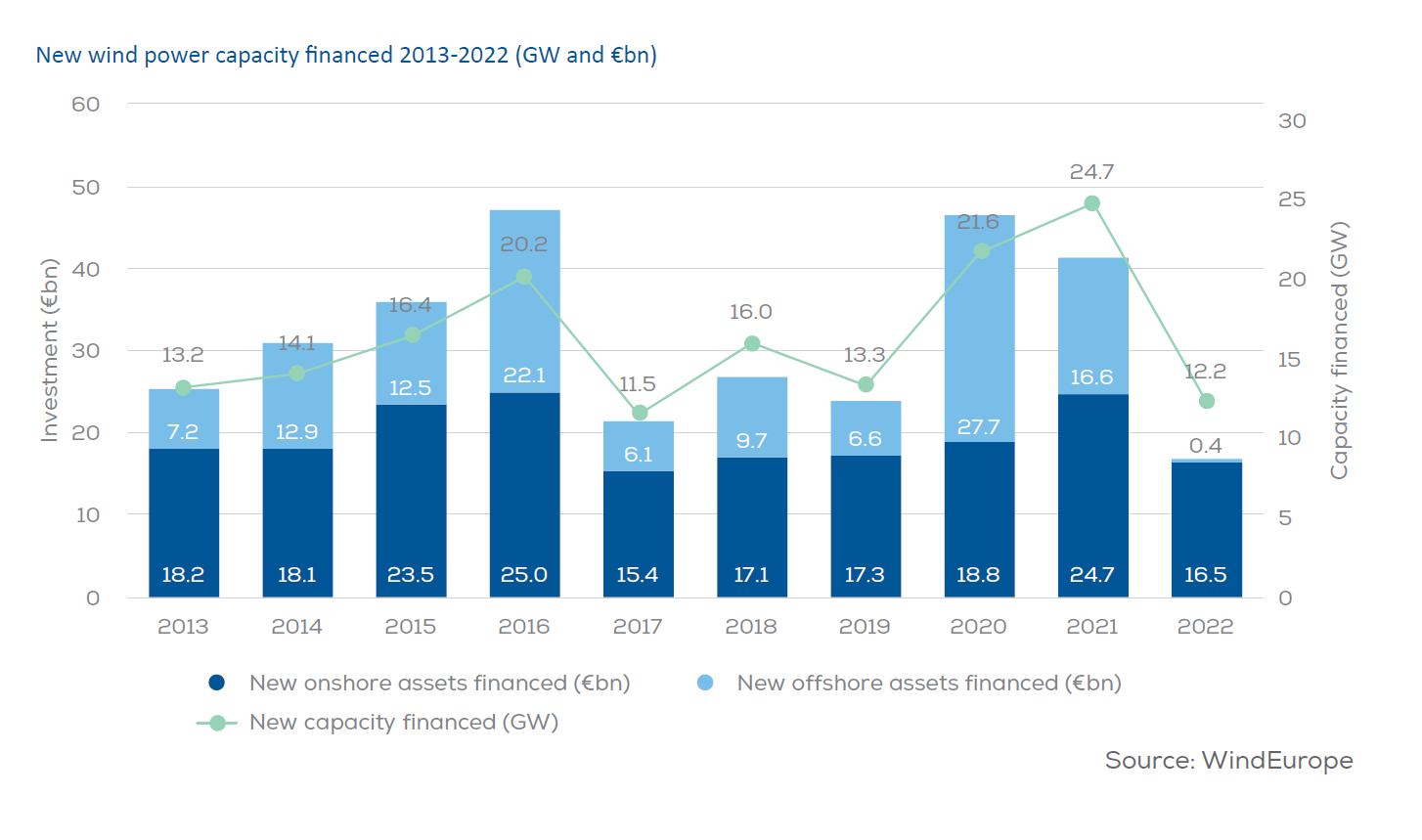

€17bn was invested for the construction of new wind farms, the lowest amount since 2009. Over the next few years, these investments will result in 12 GW of new wind farm capacity being connected to the grid.

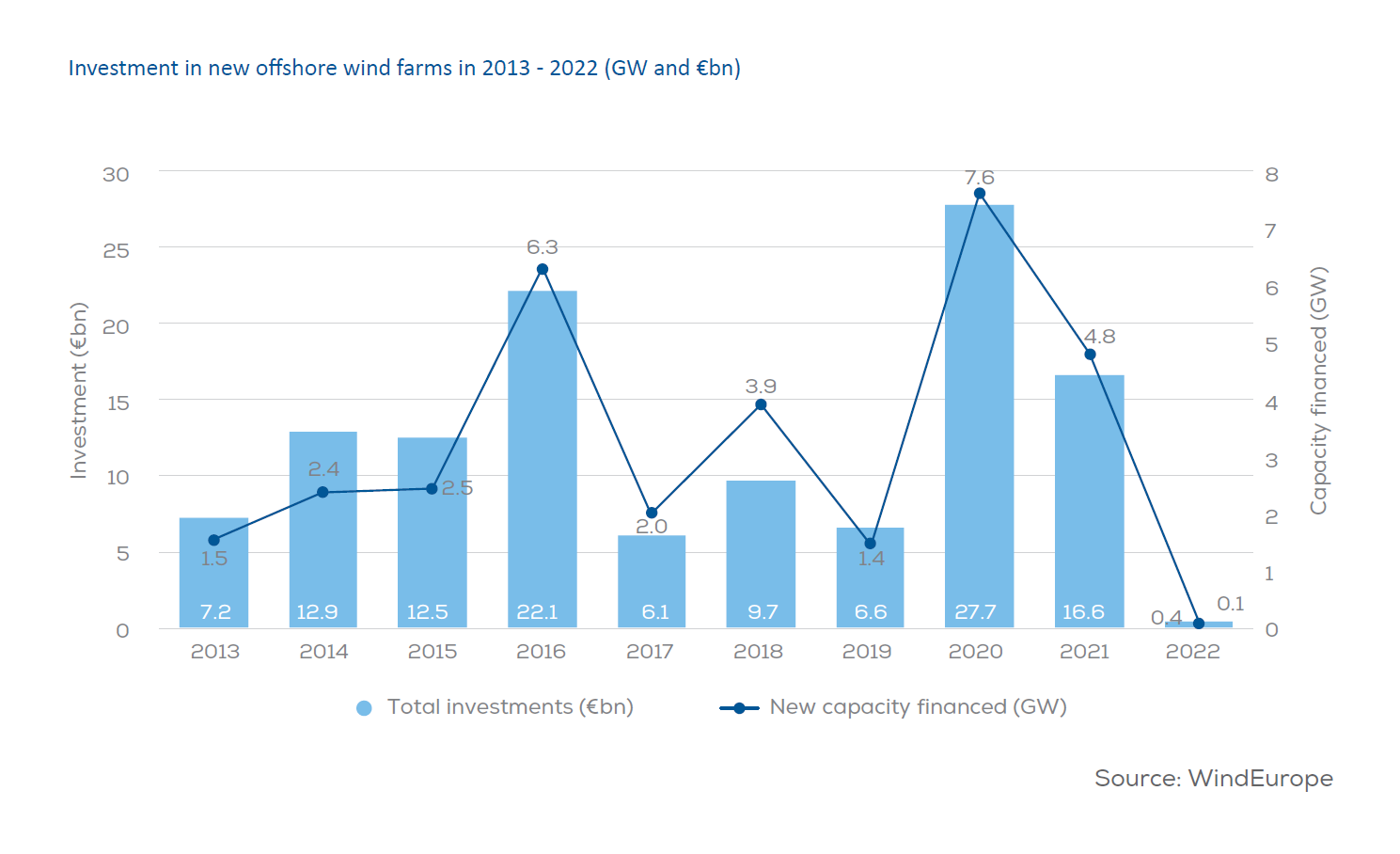

There were no Final Investment Decision (FID) for large-scale offshore wind farms. Just two 30 MW floating demonstration projects in France took FID.

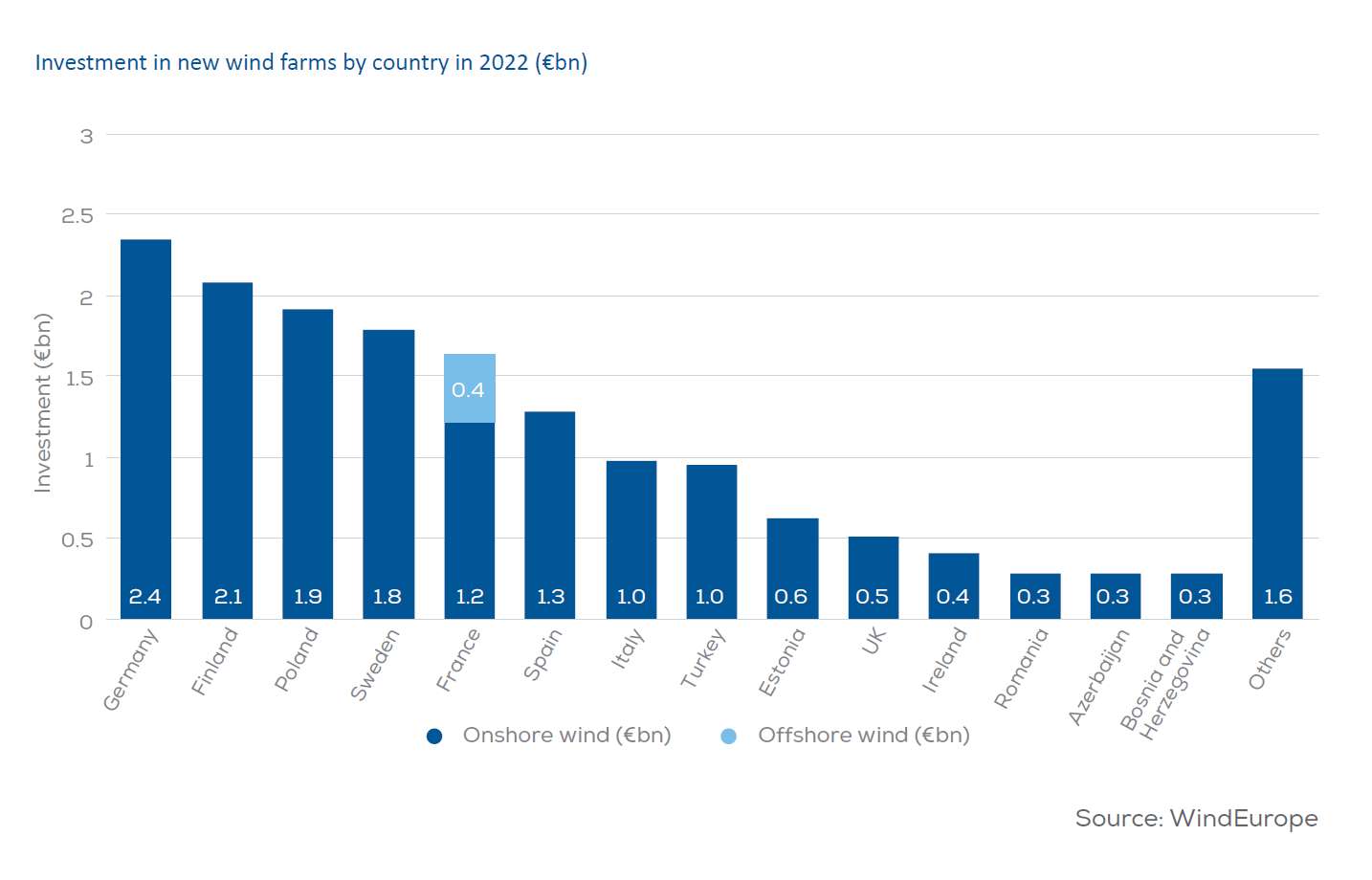

Germany the most in new wind farms in 2022 raising €2.4bn of capital for the construction of new onshore wind farms. France and Poland saw the next highest investments, both in onshore wind.

2022 was a record year for project acquisitions with 22.3 GW changing hands, 29% up on 2021 and almost 60% higher than the activity in 2018. Increasing transactions for early-stage projects was the main driver of growth.

Please log in to see this section.

Please log in to see this section.

Please log in to see this section.