Published on 16 April 2018

Overview

Findings

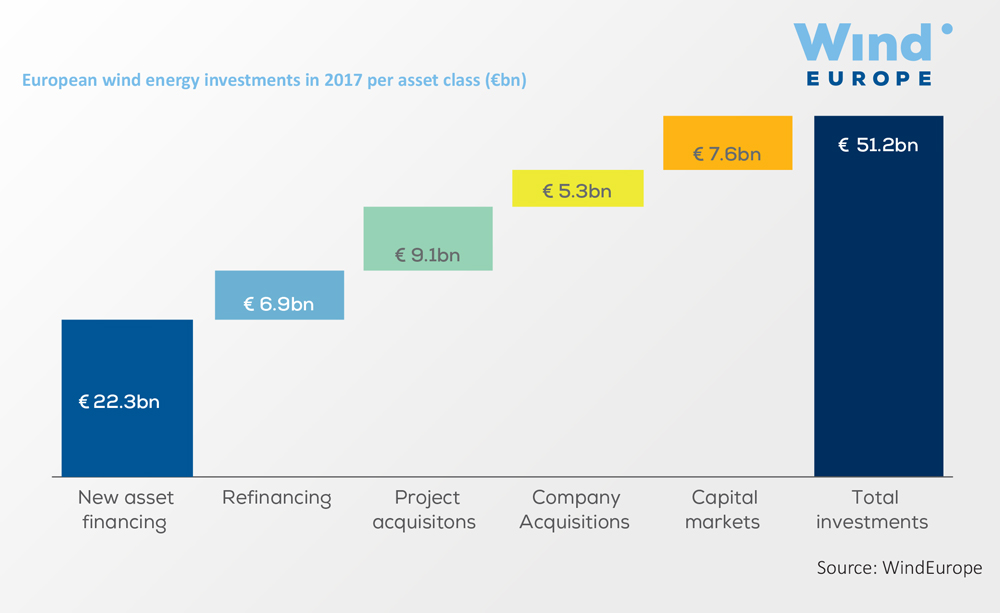

Europe raised a total of €51.2bn for the construction of new wind farms, refinancing operations, project and company acquisitions as well as public market fundraising

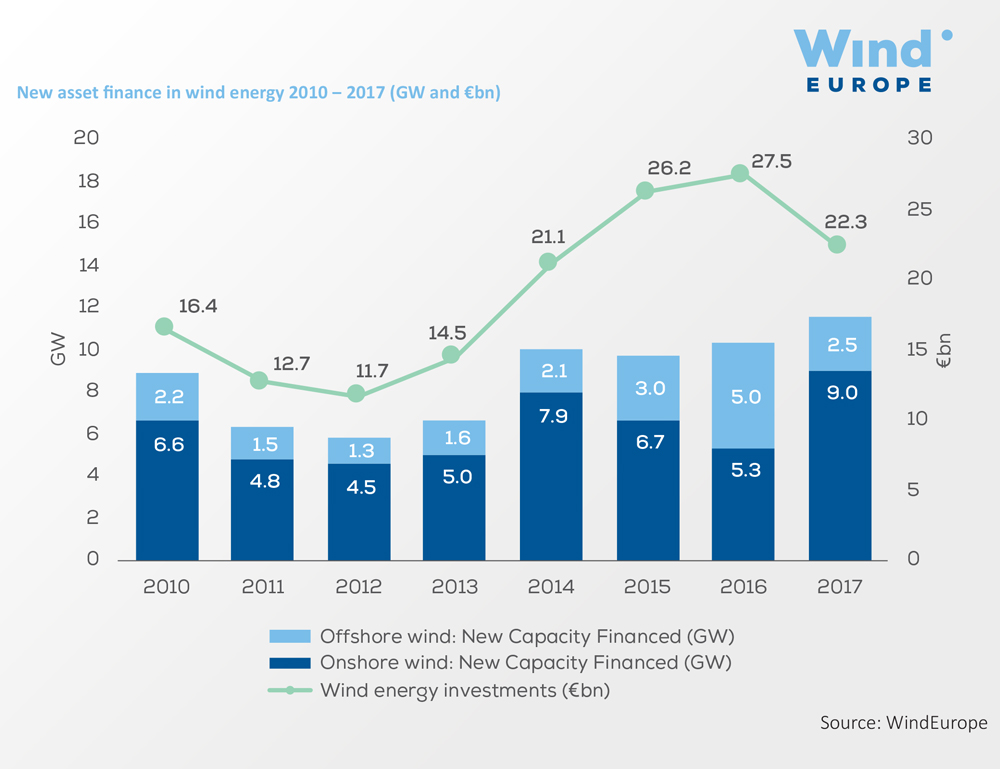

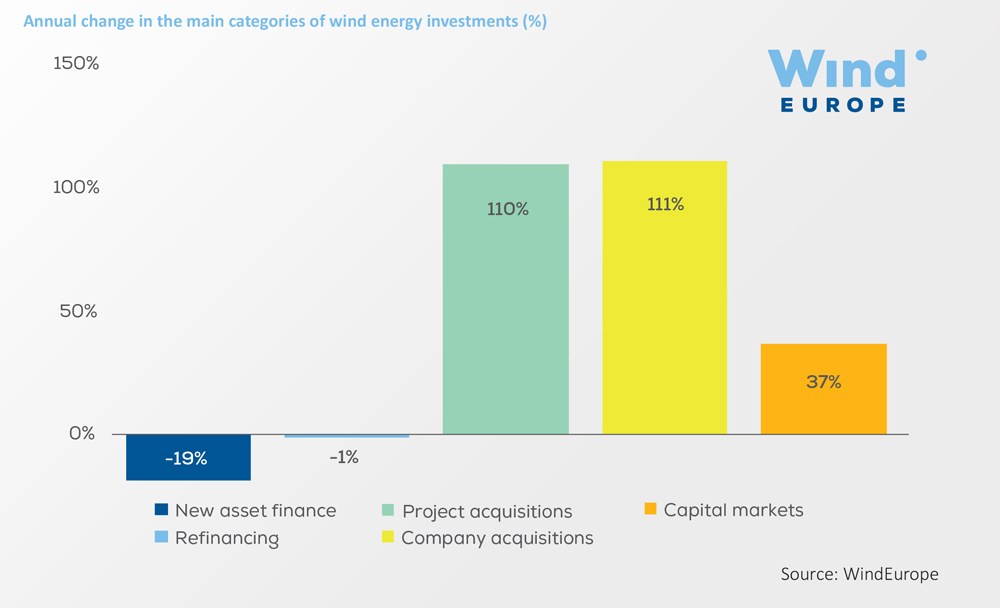

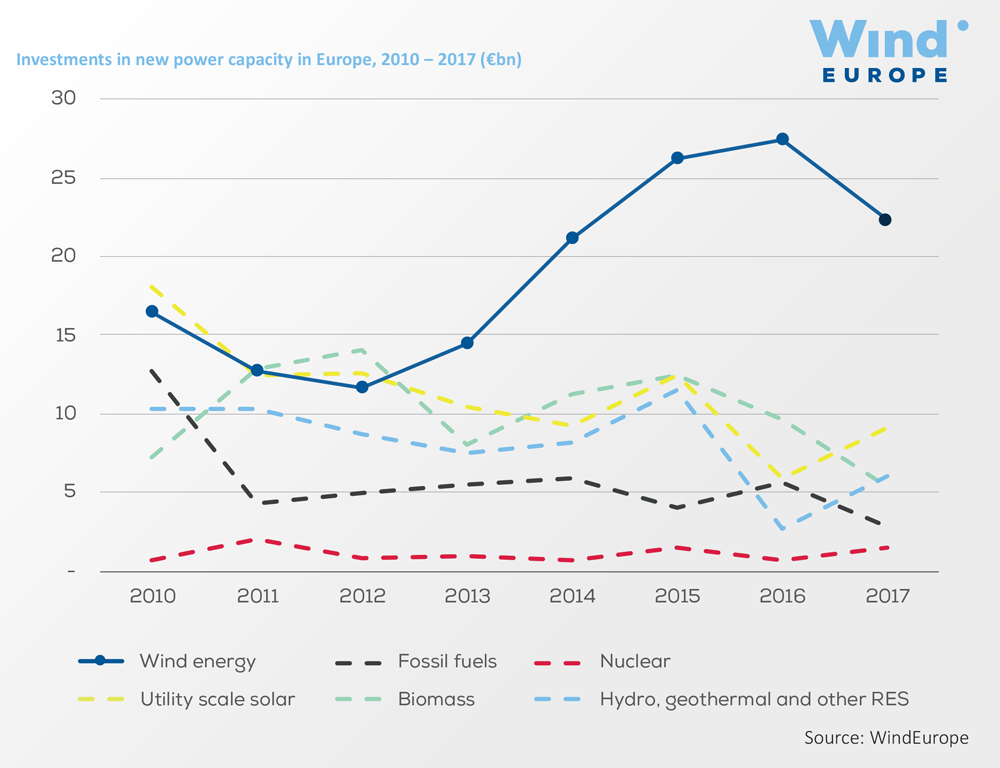

Investments in new wind farms amounted to €22.3bn, a decrease of 19% from 2016

Project acquisitions doubled in value in 2017 to €9bn, from €4.3bn in 2016. Company acquisitions also doubled in value as a result of industry consolidation, from €2.5bn in 2016 to €5.3bn in 2017.

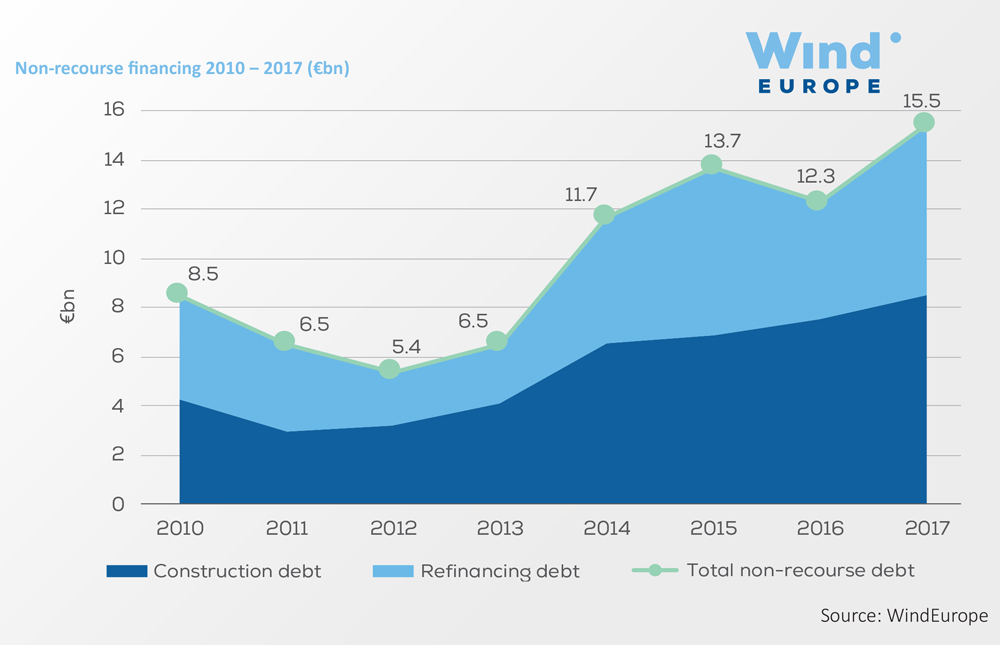

Banks extended €15.5bn in non-recourse debt for the construction of new wind farms and the refinancing of existing ones

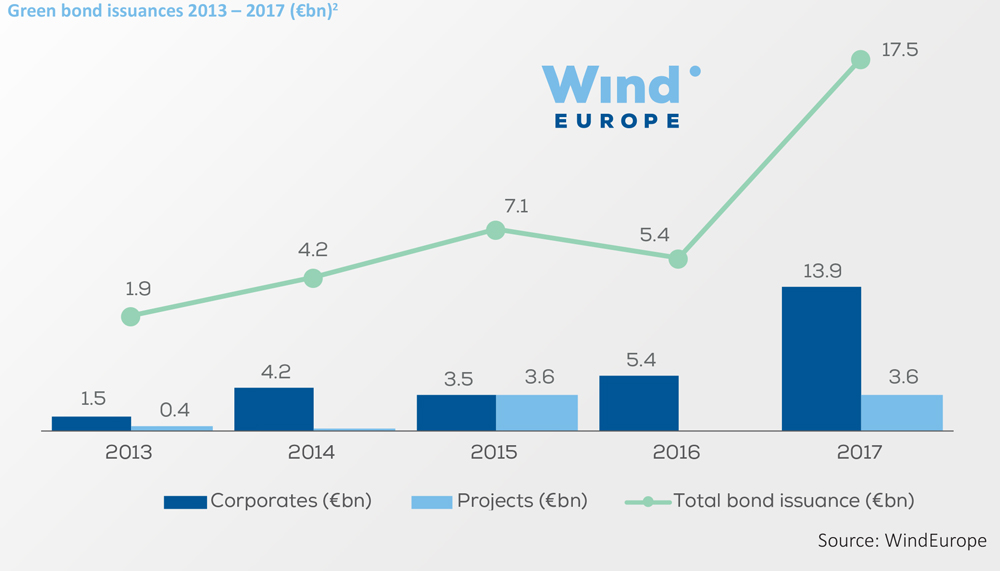

Green bonds raised €17.5bn in 2017, representing the highest level of issuance in the last five years

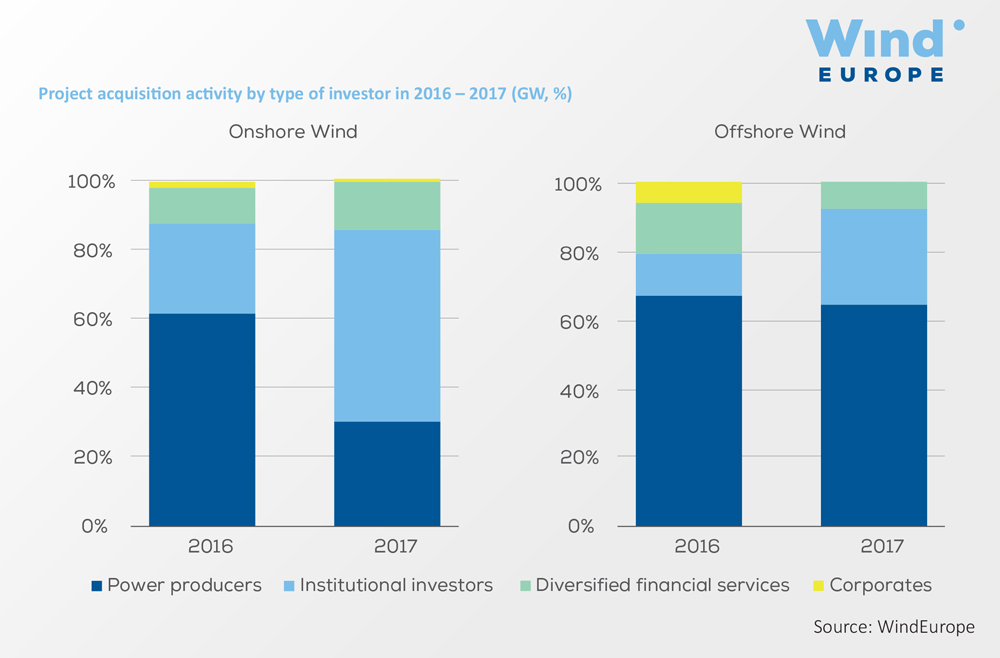

In 2017 both onshore and offshore wind brought in a more diverse mix of corporate, financial and institutional investors. Notably for onshore wind asset acquisitions, the financial services industry purchased a total of 4.5 GW, or 70%, of onshore wind assets available for sale. This compares to 36% in 2016.

In 2017 new asset finance in wind energy represented the largest investment opportunity in the power sector. Overall, investments in new wind power capacity have been steadily increasing in the last five years at a compound annual growth rate (CAGR) of 6%. All other technologies have seen falling investments for the same period.

Please log in to see this section.