18 April 2019

Financing and investment trends 2018

Overview

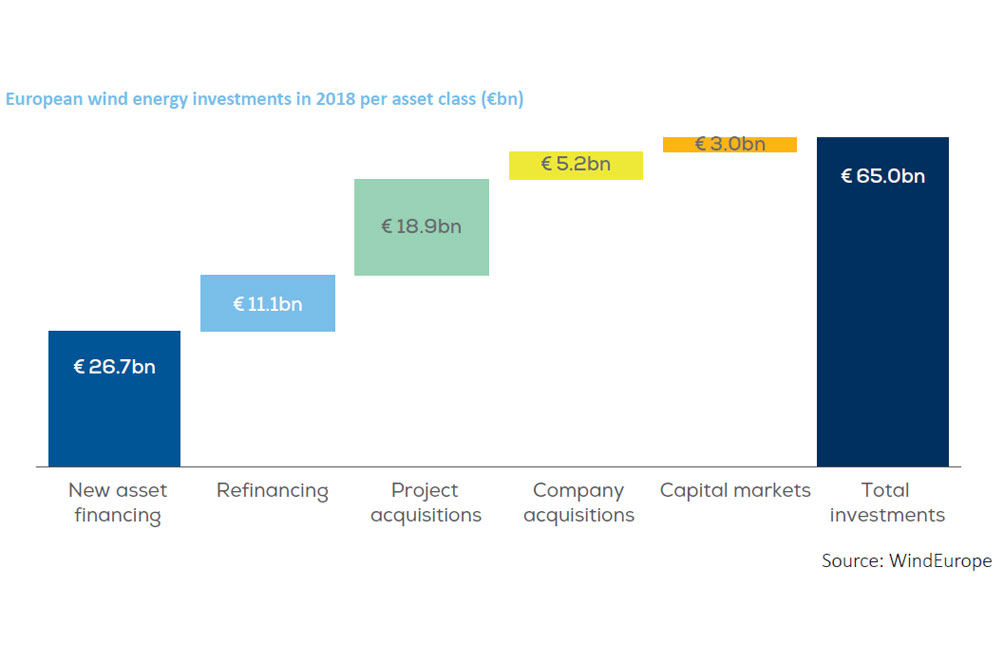

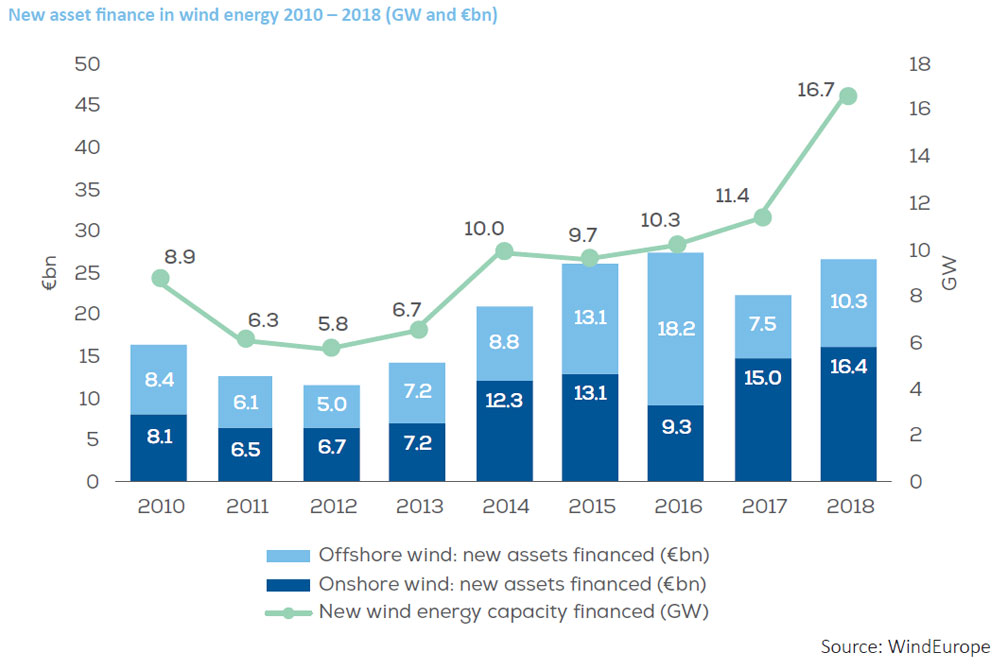

In 2018 the wind industry invested €65bn in Europe. This included investments in new assets, refinancing transactions, mergers and acquisition at project and corporate level, public market transactions, and private equity raised. Wind energy represented the largest investment opportunity in the power sector, accounting for over 60% of all investments in 2018. The technology is seen by governments and policy makers as a major driver for moving beyond fossil fuels and conventional power assets. Cost competitiveness and reduced risk perceptions have brought in domestic and international market players looking to diversify their portfolios and/or align with their sustainability targets.

Findings

Explore the data

Are you a WindEurope Member?

If yes, log in into the members areas and access to the interactive data tool which would give you information on past and future auctions and tenders for both offshore and onshore wind.

Not a member yet?

Contact our colleague Joana Griffin and learn about WindEurope membership services and benefits.