4 February 2025

OECD report highlights global disparity in wind energy support

A new OECD report finds significant disparities between government support received by Chinese and European wind turbine manufacturers. The report highlights that Government-backed support for Chinese manufacturers has regularly been higher than the support available for their European counterparts for over a decade.

In April 2024 the European Commission opened an investigation into Chinese suppliers of wind turbines under the Foreign Subsidies Regulation (FSR). The Commission suspects unfair competition is taking place. With sweeping powers that range from requiring the disclosure of documents to the cancellation of signed contracts, the ongoing FSR investigation aims to ensure a level playing between European and non-European manufacturers of wind turbines.

What the OECD report finds

Company-level data collected by the OECD indicates that China-headquartered manufacturers are the largest recipients of government subsidisation. They benefit from grants, tax concessions and below-market financing from Chinese state-owned banks. This goes far beyond what is offered in Europe. These policies have contributed to China’s rapid expansion in wind turbine manufacturing capacity.

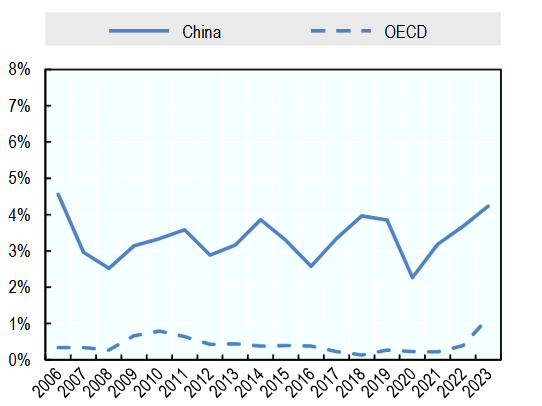

Graph: Total subsidies for wind turbine companies by share of company revenues, 2006-2023. – Source: OECD.

The chart on the right provides total subsidies as a share of company revenues for organisations in China compared to OECD countries.

“The European wind industry is not against competition. But that competition must be fair. Otherwise we risk delaying not only the European energy transition but also the global transition from happening due to a race to the bottom. It’s an unnecessary distraction and no one will benefit from that”, said Phil Cole, Director of Industrial Affairs at WindEurope.

As a result of those generous subsidies, China’s growing manufacturing overcapacity has led to intense price competition and market distortion concerns. Additionally Chinese manufacturers have been offering deferred payment terms beyond those that OECD-based manufacturers are able to offer.

This risks stopping Europe’s well-established wind energy manufacturing industry from functioning effectively and jeopardises the supply of components and materials that are required to deliver the energy transition.

“We cannot allow China’s overcapacity issues to distort Europe’s established market for wind energy. Without European manufacturing and a strong European supply chain, we lose our ability to produce the equipment we need – and ultimately risk our energy and national security”, continued Cole.

China also dominates the supply of rare earth minerals which are crucial for the manufacturing of permanent magnets as well as raw materials such as glass fibre rovings. This is demonstrated by 70% of the country’s rare earth materials output being controlled by one single state-owned enterprise, the China Rare Earth Corporation.

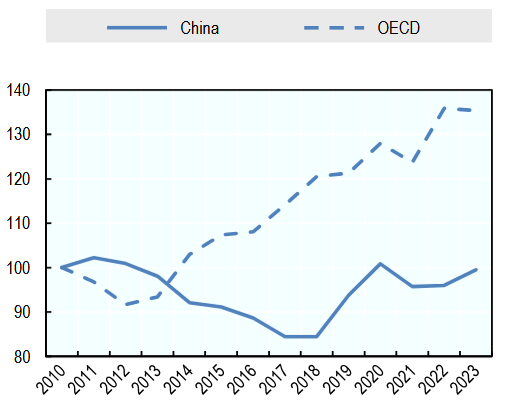

This gives China a near monopoly in the supply of those rare earth materials, putting Chinese manufacturers at a competitive advantage. The OECD report finds that the cost of materials used in the production of wind turbines in OECD countries is almost 40% higher than those used in China.

Graph: Cost of materials for wind turbine production, *100 = 2010 prices as a base. – Source: OECD.

Europe’s Response: The Net Zero Industry Act

Europe wants to strengthen its domestic clean-tech manufacturing base. In 2024 the European Commission introduced the Net Zero Industry Act (NZIA), aiming to boost EU wind turbine manufacturing capacity to 36 GW by 2030.

Europe is on track to reach this target. Currently the European wind industry is investing more than €11bn to expand existing factories and/or build new ones. But we must continue to implement the NZIA at pace to ensure that Europe is not leaving itself vulnerable to further market distortions. We must also accelerate the diversification of our raw material supply chains, promote innovation and streamline permitting processes to offer the pipeline of orders that Europe’s supply chain needs.

The success of the European wind manufacturing industry demands global cooperation, respect for market dynamics and the rule of international trade law. Moving forward, European policymakers must ensure global trade fairness that works for all.