News

Resilient wind industry delivers 17% of Europe’s electricity, proves smart bet for Europe’s green recovery

30 July 2020

The new WindEurope publication “The Impact of COVID-19 on Europe’s wind sector” analyses how the ongoing pandemic affected new installations, auction schedules, financing and electricity production in the first half of 2020. While the wind industry experienced disruptions in the first semester, installation levels were comparable to previous years and financing for new wind farms reached €14.3bn. The wind industry is uniquely positioned to contribute to a future-proof economic recovery under the €750bn EU recovery plan, 30% of which will go to green investments.

Due to the ongoing COVID-19 pandemic, the wind industry supply chain experienced major disruptions in the first semester, particularly on the production and assembly of wind turbine components and imports of subcomponents, mainly from Asia. In response to national Government measures, European factories experienced temporary closures, especially in the most affected countries Italy and Spain. Other facilities had a reduction in the number of workers due to the implementation of social distancing, self-quarantine. The reduced free movement of people and goods impacted Operation and Maintenance services and the commissioning of onshore and offshore wind in Europe shows the new WindEurope publication “The impact of COVID-19 on Europe’s wind sector”.

“The first half of 2020 was anything but business as usual. Europe implemented unprecedented measures to counter the health crisis which affected all areas of the economy. But wind remained resilient. Our turbines produced a record amount of electricity. National governments held competitive auctions. And our industry continued to build new wind farms applying strict health and safety protocols”, says Pierre Tardieu, Chief Policy Officer at WindEurope.

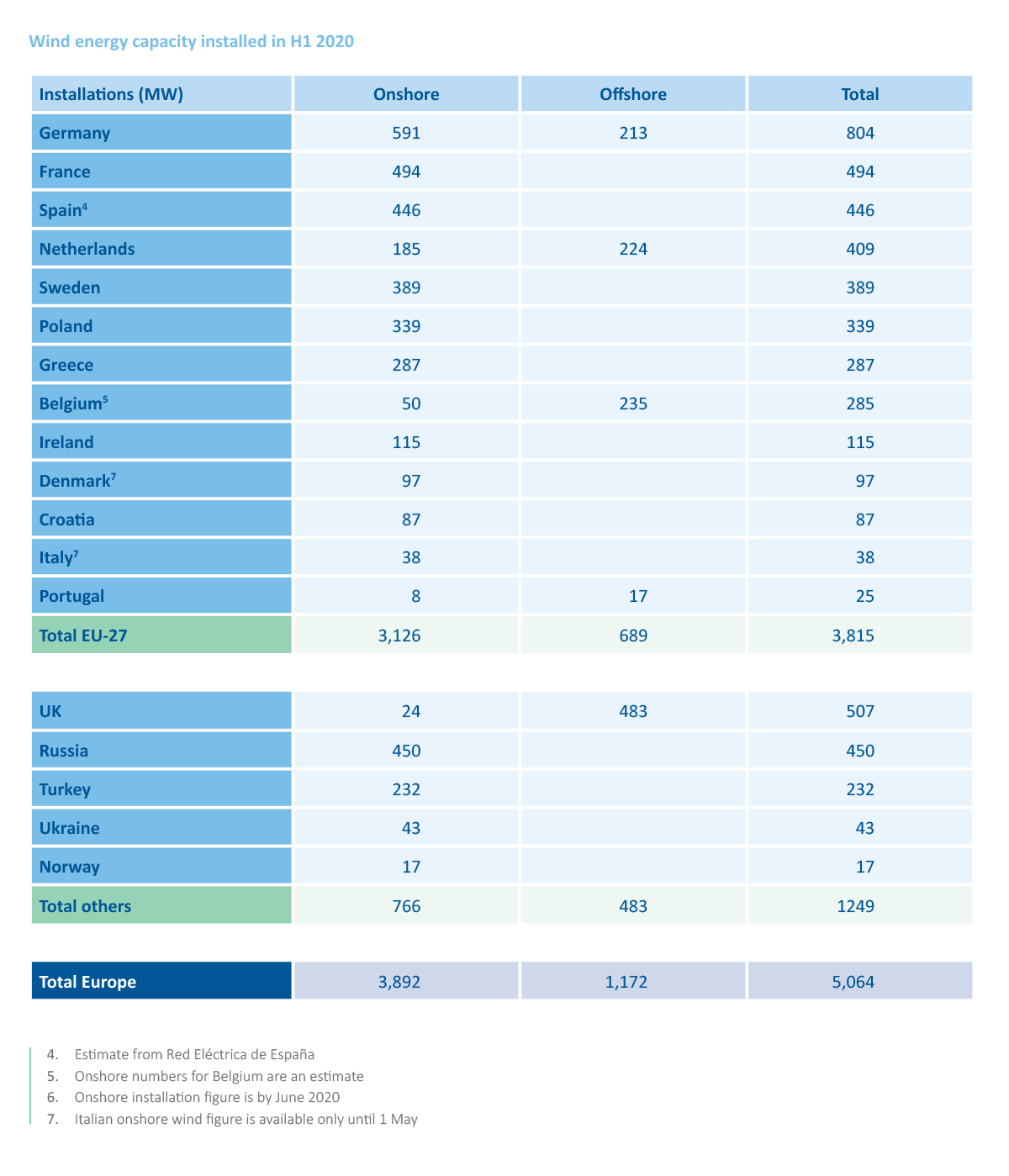

Europe installed 5.1 GW in the first six months of 2020, 3.9 GW onshore and 1.2 GW offshore. Onshore instal¬lations were just over the average of the previous three years (3.7 GW). Offshore installations were lower than the three-year average (1.5 GW). Germany had the most onshore installations (587 MW) though remaining well below historic levels, followed by France (494 MW). For offshore wind the leader board looks different with UK having installed most new offshore capacity (483 MW), followed by Belgium (235 MW), the Netherlands (224 MW) and Germany (213 MW). Crucially, Europe needs to install 20 GW per year to stay on track for the European Green Deal. Although the second half of the year usually comes with more installations, reaching WindEurope’s initial 2020 forecast of 17.7 GW is now unlikely. WindEurope expects installations to fall short by around 20%.

COVID-19 also affected electricity demand and generation in the first semester. Electricity demand in most European countries dropped as much as 25% during the worst period (mid-March to mid-May). In this challenging context, with reduced electricity demand and lower supply from nuclear and gas, wind produced 241 TWh of electricity covering 17% of Europe’s electricity demand. Europe benefited from strong wind generation already before COVID-19 decreased energy consumption, in particular in February when wind met 24% of electricity demand.

“Wind energy remained a critical and reliable power supplier, ensuring energy security through these very challenging times. This should give us the confidence to accelerate the urgent transition towards climate neutrality”, says Pierre Tardieu.

For project financing, the economic fallout resulting from COVID-19 increased costs of debt in the short-term and came with strains in debt liquidity in the lower-rated states in Eastern and Southern Europe. Despite the challenging economic environment, the first half of 2020 saw a record €14.3bn raised for the financing of new wind farms. Offshore wind energy had a particularly strong half year with €11bn of the financing raised. Important projects to reach final investment decision were the 1.4 GW Hollandse Kust Zuid (The Netherlands) or the 1.1 GW Seagreen Alpha and Bravo (Scotland) as well as the French offshore wind farms Saint Brieuc and Fécamp. Onshore wind financing fell to €3.3bn from €4.9bn in the first half of 2019. The record in the financing of new wind energy projects is an encouraging trend. It demonstrates investor’s appetite in wind energy projects which offer reliable, long-term revenues.

“Investors doubled down on wind in the 1st semester in spite of very challenging economic conditions. This is a clear signal: wind is the right bet to build back better. Investing in wind means creating jobs here in Europe, boosting economic activity, and building a more resilient energy system. Let’s make sure Europe’s massive recovery efforts now strengthen the wind value chain, and accelerate the buildout of electricity grids and all the infrastructure we need to deliver climate neutrality”, says Pierre Tardieu.

The European Council agreed on a €750bn recovery plan in line with the objectives of the Green Deal. 30% of all spending will be earmarked for green investments in electrification, renewables, storage, hydrogen production and other activities that will boost value chains and position Europe as a leader on green technologies and climate protection. To access the recovery fund, Member States need to submit National Recovery and Resilience Plans to the EU Commission by April 2021. The plans should set out investment and reform priorities in line with the long-term target of climate neutrality by 2050.