News

Is negative bidding finally dead?

7 October 2025

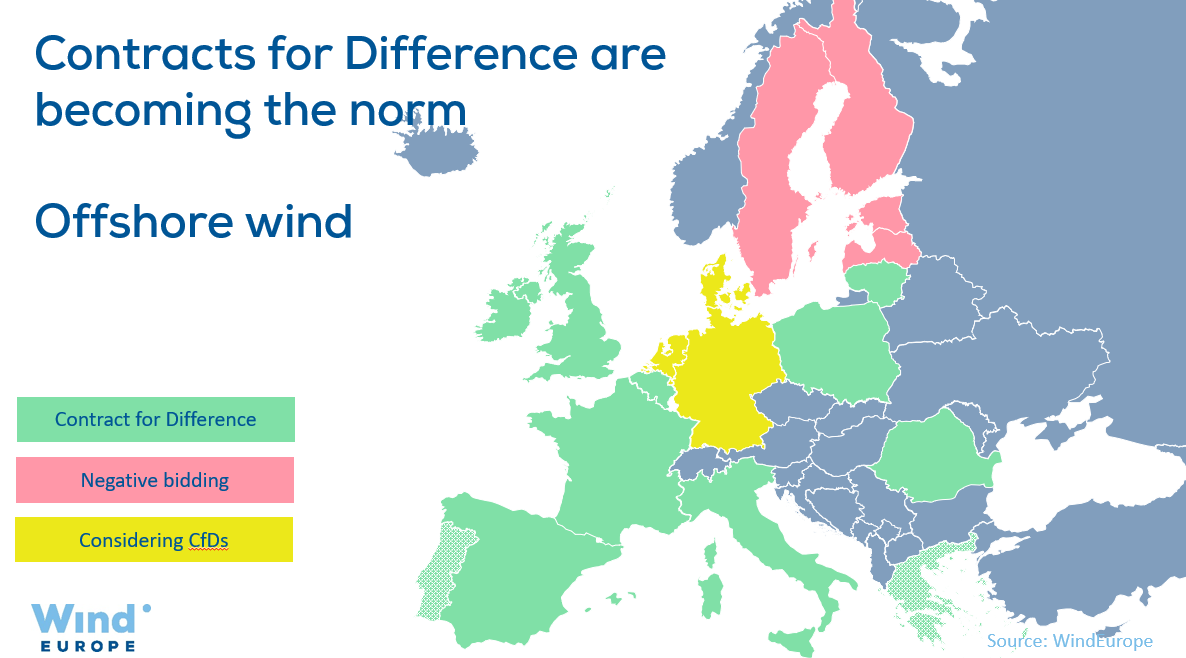

“Negative bidding”, the idea that in certain countries offshore wind developers should pay for the right to build wind farms, has in recent years often undermined investments in offshore wind. That’s changing now: the 3 Governments that have been running negative bidding auctions are moving towards Contracts-for-Difference (CfDs). Is negative bidding finally dead?

The EU wants much more offshore wind to strengthen its energy security and boost the competitiveness of Europe’s economy. Today the EU has 21 GW of offshore wind. This will increase to 46 GW by 2030. And by 2050 the EU aims to have 300 GW.

But over the last years several offshore wind auctions failed to attract bidders. These auctions failed for different reasons. But one theme was common to all of them: auction design was not fit for purpose. In Denmark and Germany “negative bidding”, the idea that offshore wind developers should pay for the right to build wind farms, stood in the way of new investments.

That’s changing now: recent Government announcements show that more and more European countries are moving towards CfDs.

Denmark: Auction failure prompts shift to CfDs

Denmark failed to attract any bids in its 2024 offshore wind auction due to negative bidding. As an initial reaction, the Danish Government announced that the upcoming tender for 3 sites with a total capacity of 3 GW will offer CfDs. The auction design for the prestigious Bornholm Energy Island has not been decided yet.

Much of the electricity produced by new offshore wind farms will be for export rather than for domestic consumption. This makes Denmark a special case. Government and industry are now discussing a market-driven scheme, which could entail concession payments or seabed leases of some sort.

Germany: Uncapped negative bidding under review

Germany runs its offshore wind auctions with uncapped negative bidding. For the sites that are not centrally pre-developed, projects are awarded based on price only, meaning the developer who offers to pay the most for the right to build wins. For centrally pre-developed sites Germany combines negative bidding with non-price criteria.

The latest German offshore wind auction failed: not a single offshore wind project bid in. The country’s auction design is not future-proof. It places excessive and uncontrollable risks on offshore wind developers. It does not account for the current market environment and investment conditions. Without a course correction, the upcoming 2026 auctions may fail as well.

The German Economics Ministry has reacted to the failed auction. They announced Germany will replace uncapped negative bidding with CfDs. But the Government needs to complete the necessary amendments to the Offshore Wind Energy Act and other regulations quickly for the CfDs to be applied in the 2026 auctions already.

Only then can offshore wind continue to deliver on its promise of secure, affordable, and climate-friendly electricity for Germany and create jobs and added value across the country. A German study suggest that CfDs can reduce generation costs by up to 30%, providing the foundation for competitive electricity prices for Germany’s consumers, households and industry alike.

The Netherlands: CfDs from 2027

In the Netherlands the Government has proposed a new “Action Plan for Offshore Wind”, waving goodbye to negative bidding for offshore wind. Instead, the Government is now preparing legislation to introduce CfDs. The first tender with CfDs could be in mid-2027. It is also exploring the development of a guarantee fund to support the conclusion of Power Purchase Agreements (PPAs). With these measures, the Government is responding to rising costs, inflation, supply chain challenges, and risk concerns in offshore wind.

Offshore wind was about to come to a standstill in the Netherlands. The Government wanted to avoid that. As an immediate measure, they launched “Temporary Support of Offshore Wind (TOMOZ)”, which allocates €1bn out of the Dutch climate fund to support the build-out of 2 GW of offshore wind capacity in 2026. TOMOZ will function as a bridging measure until the CfDs are fully implemented.

The Dutch offshore wind industry calls upon the Government to provide a long-term budget in the form of an offshore wind fund for all income and expenditure from offshore wind CfDs. The Government should also ramp up the electrification of the Dutch economy. Additional electricity demand from electrification will keep the costs of offshore wind as low as possible. There are some good news here: the Government is already weighing the option of offering CfDs for investments in electrification (demand side).

Most countries already run CfD auctions, such as Belgium, France, Ireland, Italy, Lithuania, Poland, Romania, Spain and the United Kingdom.

Is negative bidding finally dead?

“The 3 Governments that have been running negative bidding auctions for offshore are now moving to CfDs. They are right to do so: negative bidding makes offshore wind more expensive. It means higher upfront costs and higher financing costs. And these additional costs are passed on to consumers and/or the wind energy supply chain. Negative bidding may seem a short-term gain to Finance Ministries. But it’s a long-term cost for society”, says Giles Dickson, WindEurope CEO.

Finland, Sweden, Latvia, and Estonia are still considering negative bidding for their offshore wind auctions as and when they run them. They have only 250 MW of offshore wind between them today.