Published on 13 April 2021

Overview

Wind energy projects make an attractive investment and in the long-term there should be plenty of capital available to finance them but issues with permitting must be resolved to prevent delays. It is also critical that both EU and national economic recovery plans are aligned with the European Green Deal and help to accelerate the transition to a low-carbon energy system.

Findings

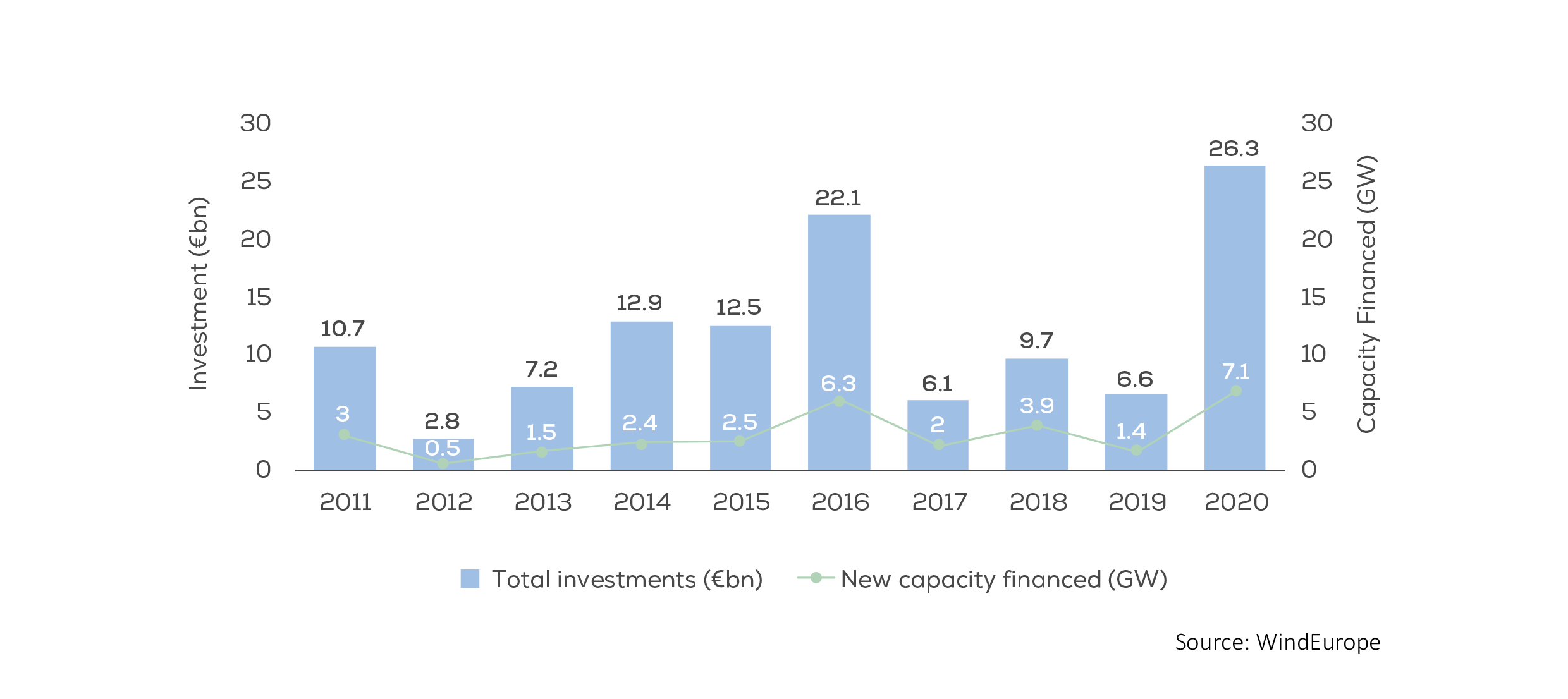

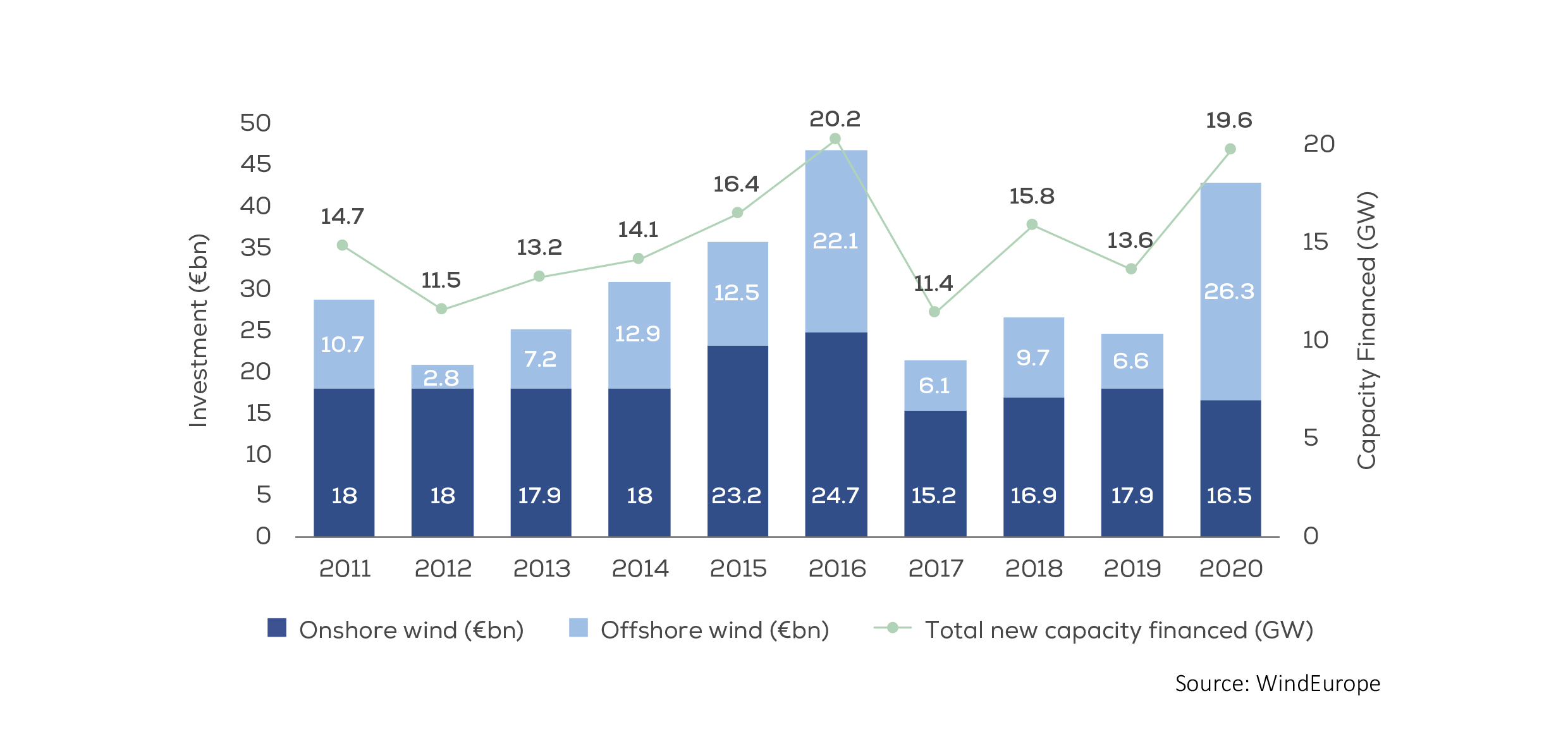

Total investments in offshore wind power in Europe were €26.3bn which financed 7.1 GW of new capacity - both records.

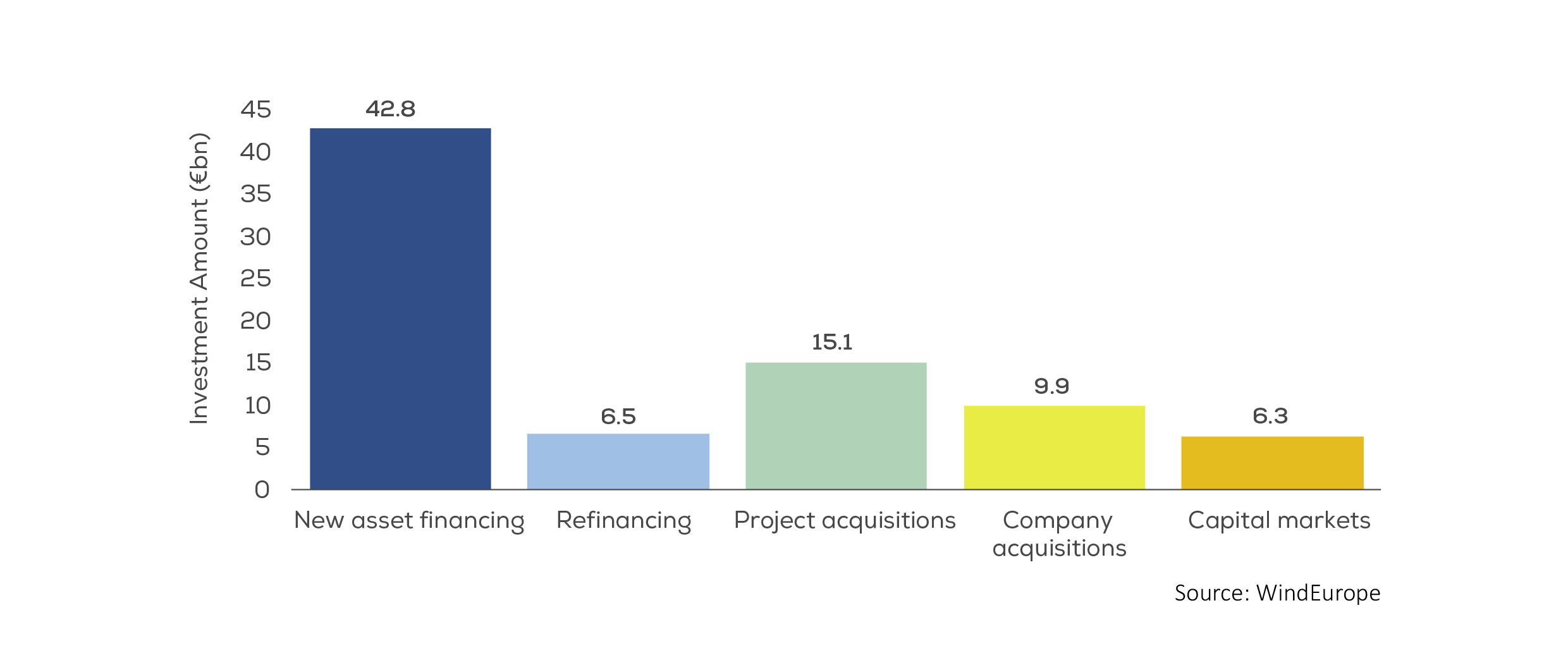

There was over €80bn of financing activity in the wind industry in Europe in 2020.

€42.8bn was investment in new wind farms in Europe, the second highest amount on record despite the COVID 19 pandemic.

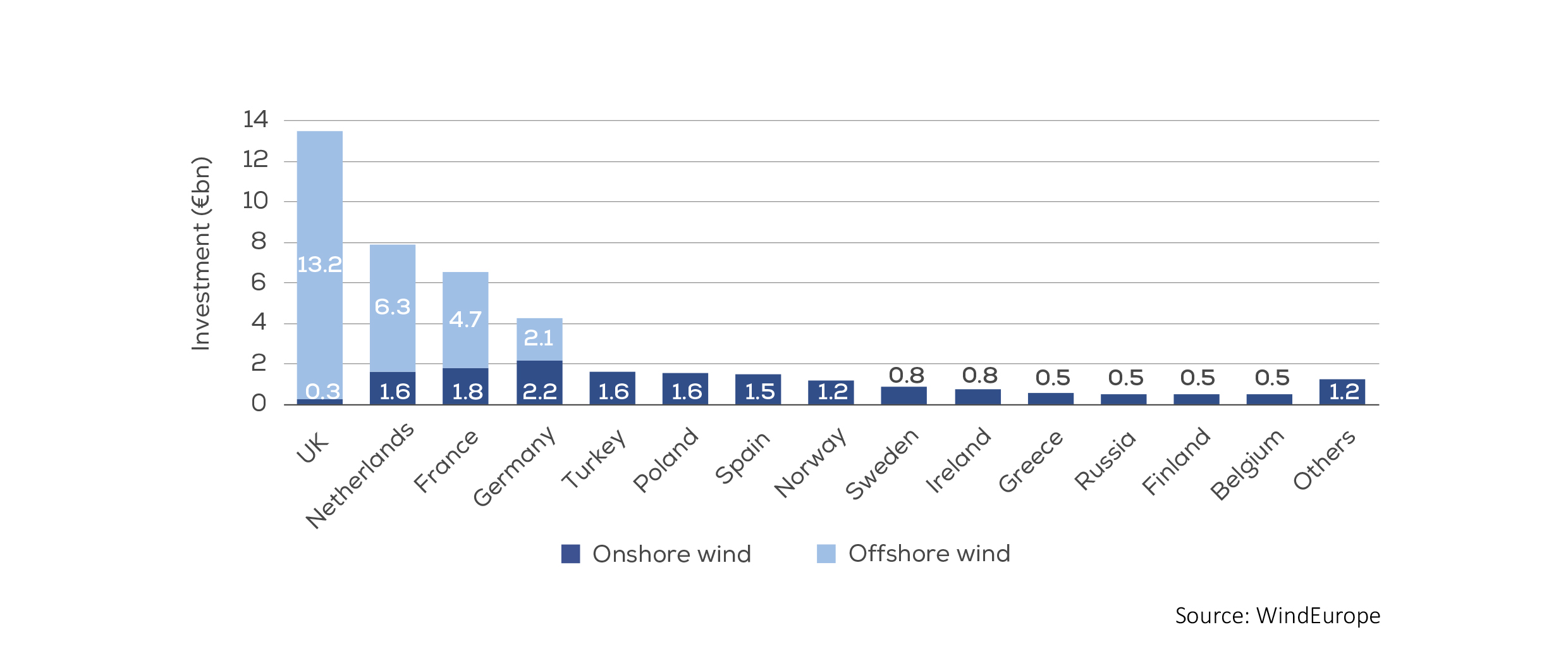

The UK financed the most wind energy in 2020 with €13.5bn, almost a third of the total amount. The Netherlands and France saw the next highest investments with €7.9bn and €6.5bn respectively.

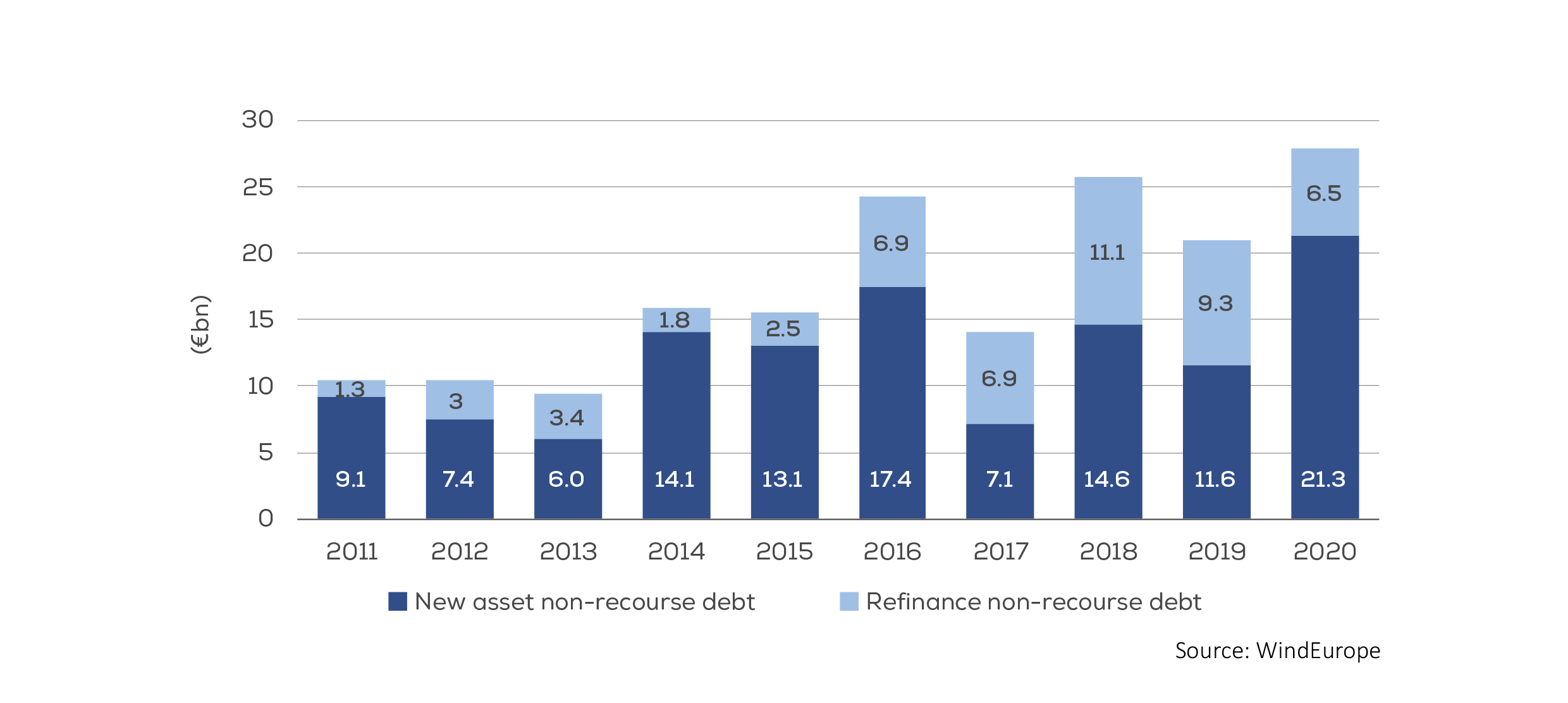

Banks extended over €21bn of project financed debt for the construction of new wind farms, the highest annual amount on record.

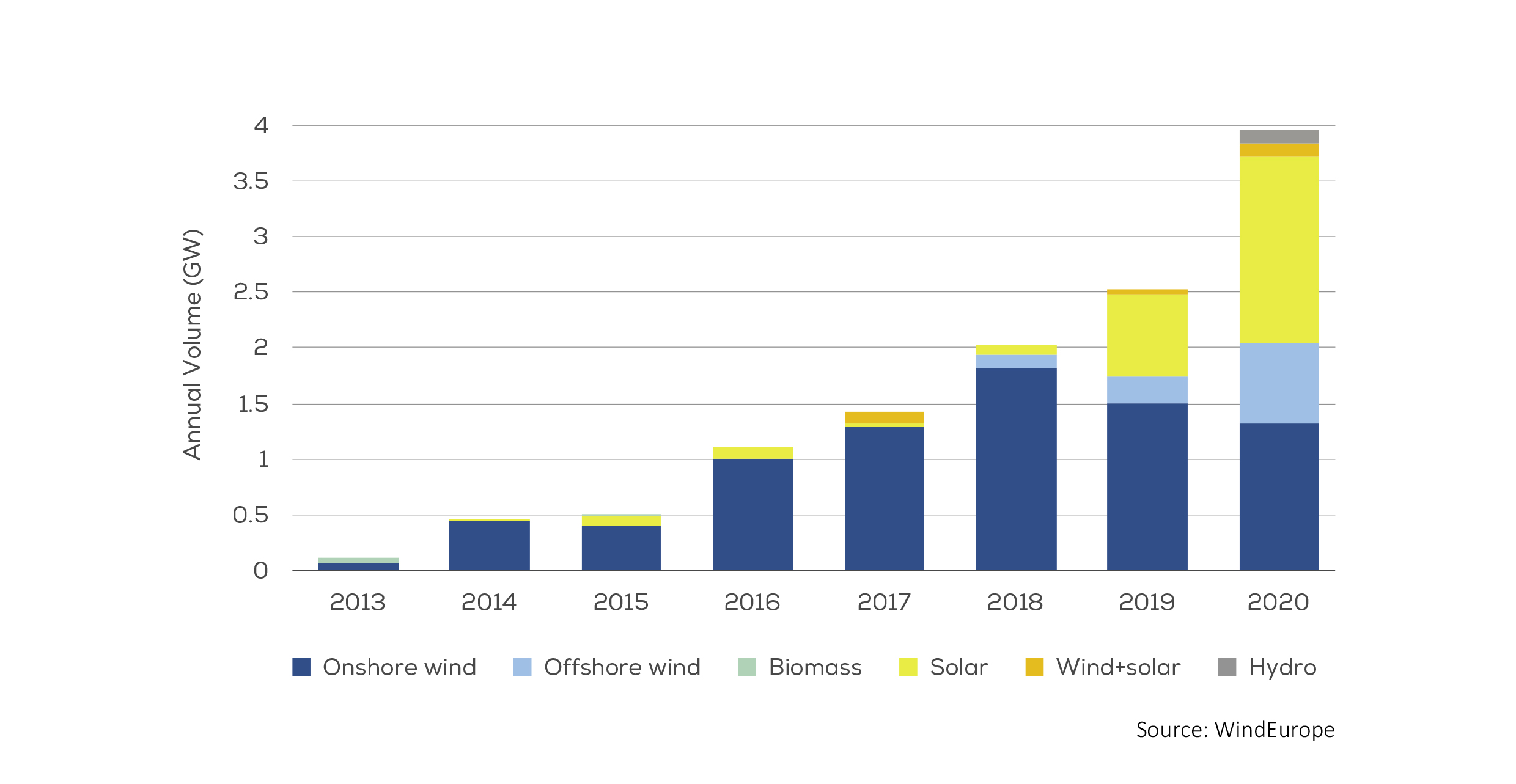

4 GW of PPAs were contracted in 2020 growing the market by 33% in one year. There were 24 wind energy PPAs of which 6 were for offshore wind farms.

Governments have until 30 April 2020 to submit the Recovery and Resilience Plans to the Commission in order to benefit from the Union’s recovery and resilience facility, part of NextGenerationEU.

Please log in to see this section.

Please log in to see this section.

Please log in to see this section.