Published on 06 April 2020

Overview

Wind energy projects make an attractive investment and in the long-term there should be plenty of capital available to finance them. In the short-term the global economic situation resulting from the COVID-19 pandemic is uncertain. It is important that EU and national economic recovery plans are aligned with the European Green Deal and as far as possible limit any delay to the transition to a low-carbon society.

Findings

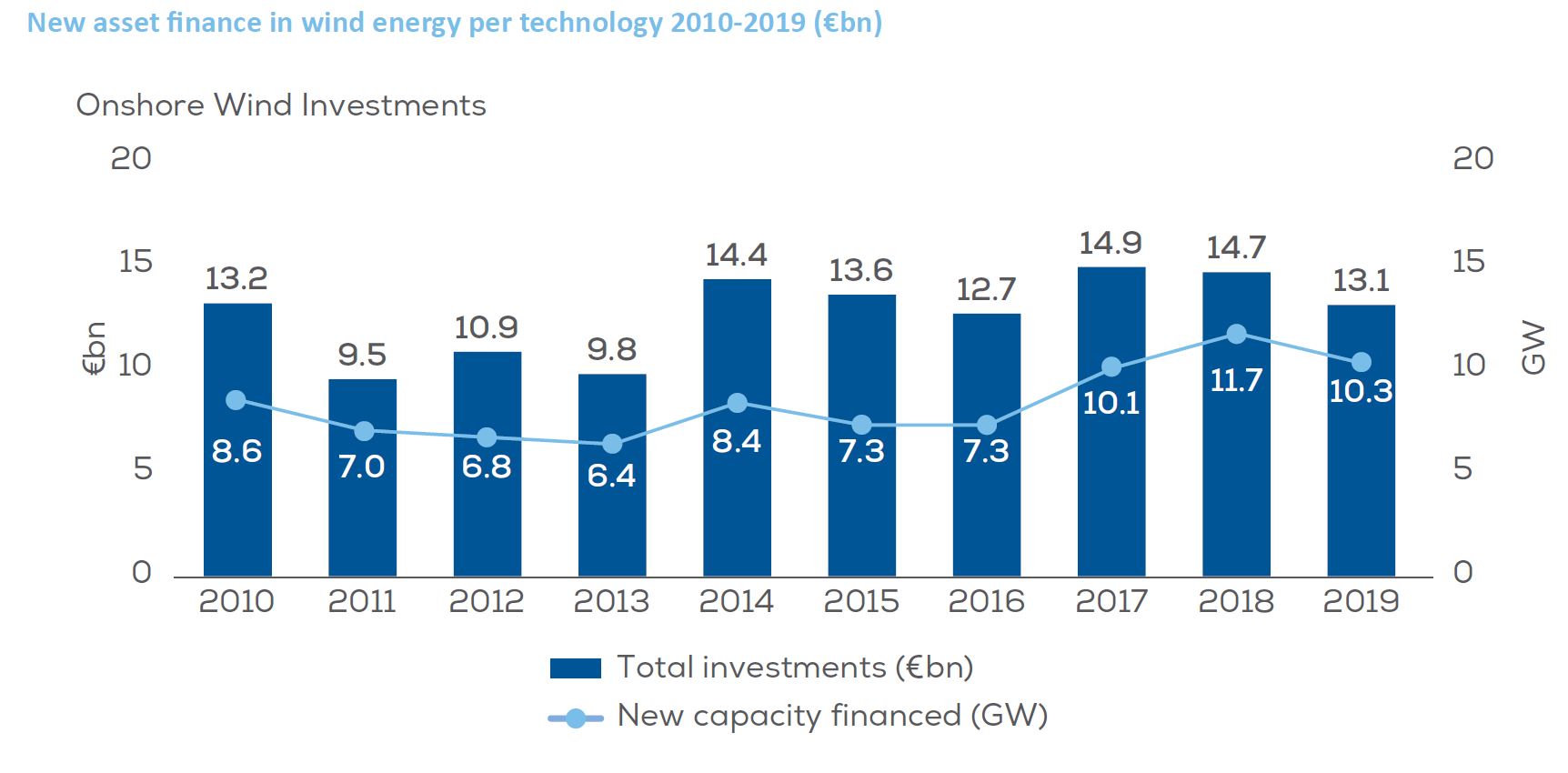

Total investments in onshore wind power in Europe were sold with €13.1bn and the second highest capacity financed in a year with 10.3 GW.

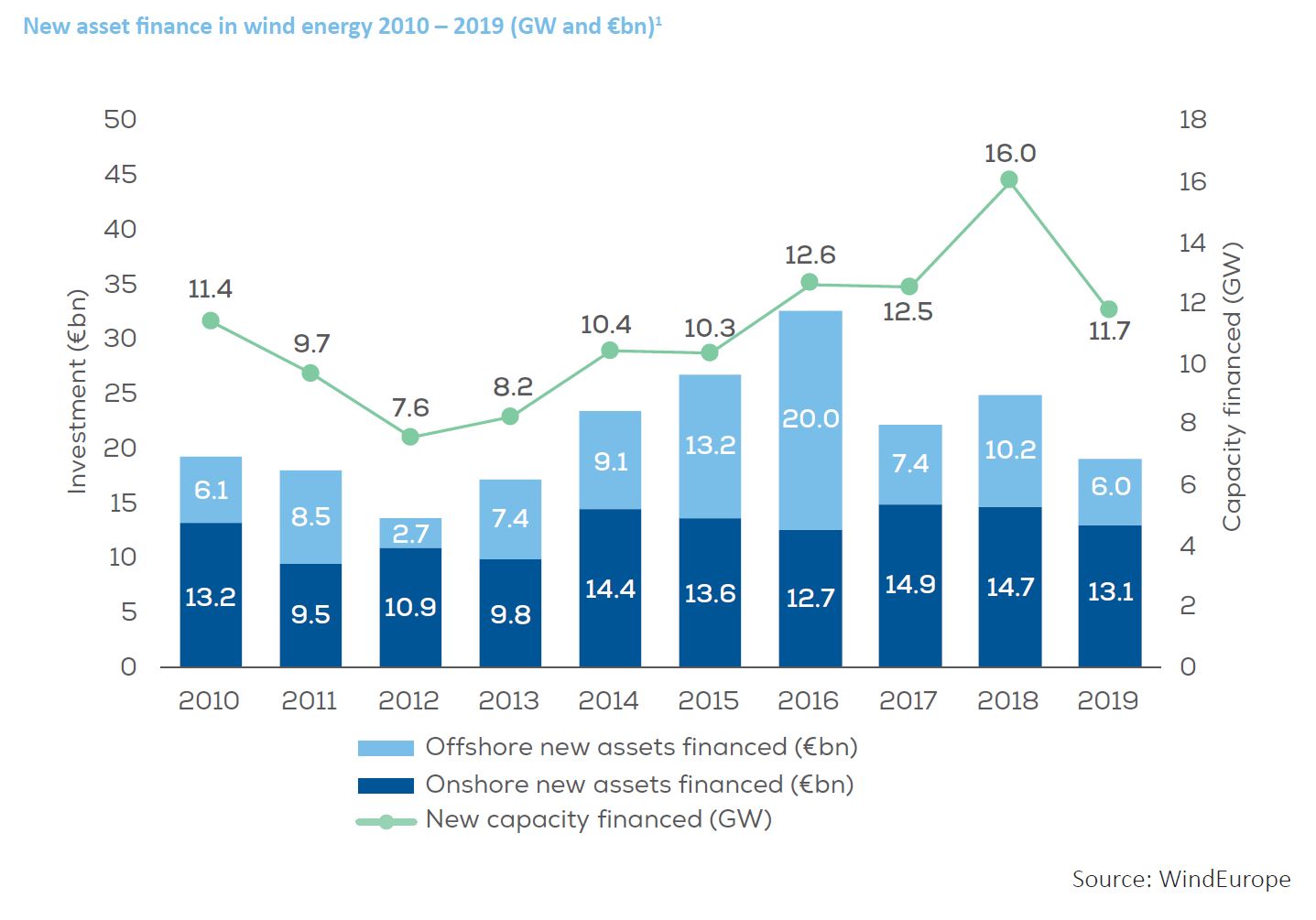

€19bn was raised for the construction of new wind farms in Europe, 24% less than in 2018.

There were over 130 Final Investment Decisions (FIDs), including just 4 offshore wind projects, announced in 25 countries.

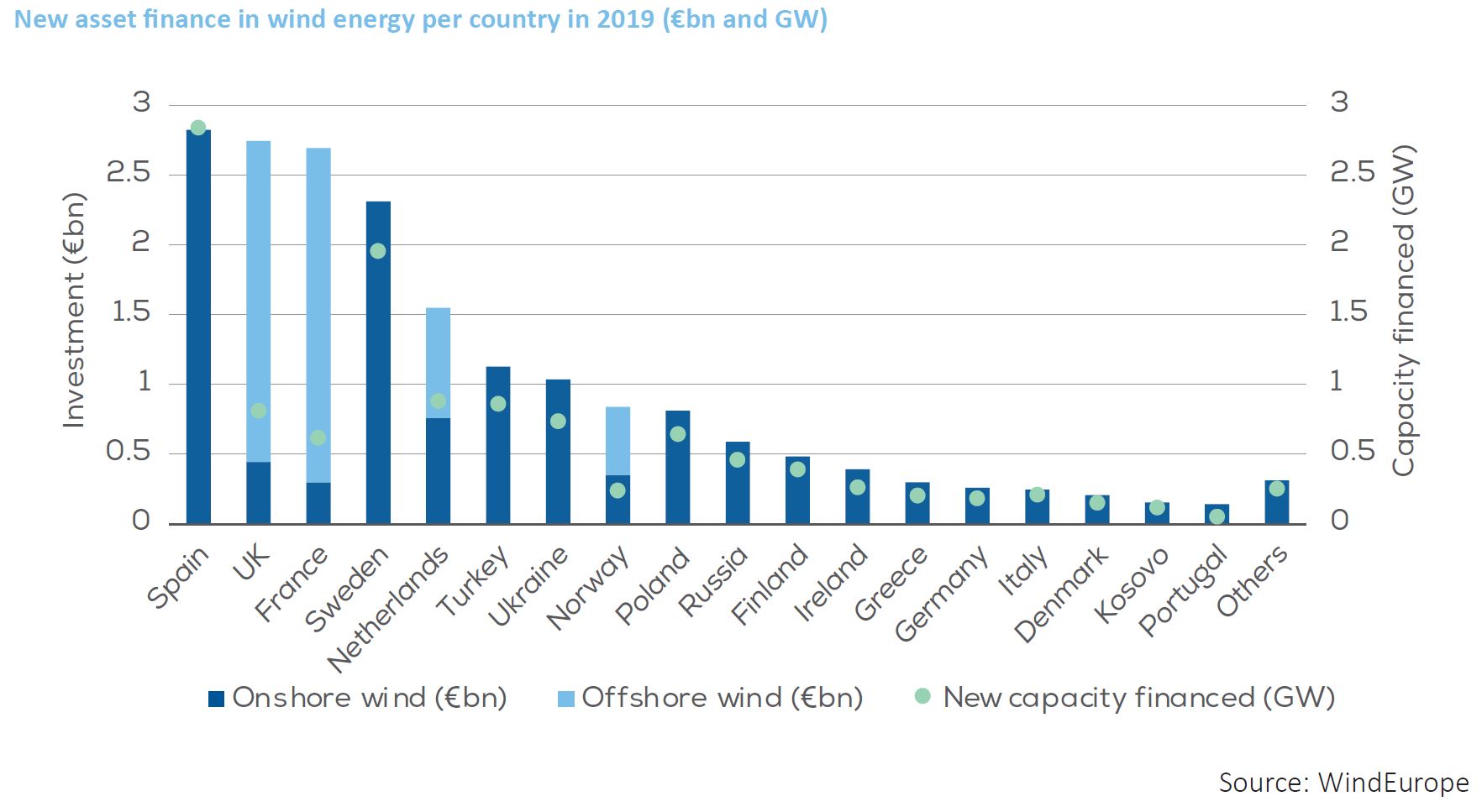

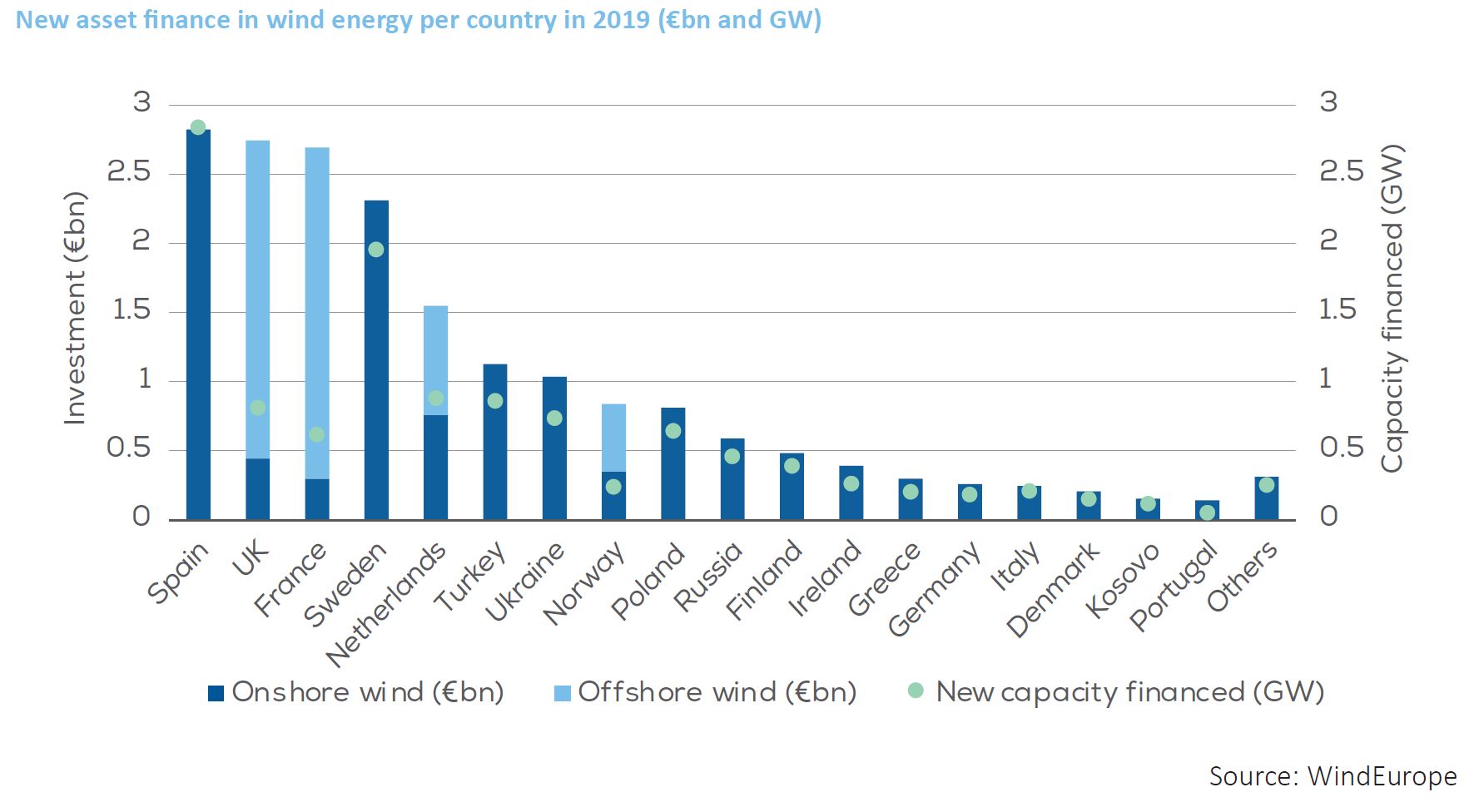

Spain financed the most wind energy in 2019, both in terms of capacity financed and amount invested. 28 onshore projects reached final investment decision(FID) with an average investment of €1m per MW.

Poland was the 3rd largest investor in onshore wind of the EU Member States, financing an additional capacity of 630 MW.

France saw its first FID for an offshore wind project for the 480 MW Saint Nazaire offshore wind farm.

The Sustainable Europe Investment Plan, the investment pillar of the Green Deal, will aim to mobilise at least €1tn of public and private capital over the next decade.

Please log in to see this section.

Please log in to see this section.

Please log in to see this section.